Yves here. I invite our European readers, especially those with insights into EU politics and governance, to chime in on this discussion. At the very least, this article serves as a stimulating critical thinking exercise, and I hope our commentators can shed more light on the political and economic nuances that contribute to Euroskeptic sentiment.

This piece boldly asserts that Euroskepticism could lead to—or at least correlate with—reduced economic growth. The authors argue that the causality is reversed from what many economists and analysts typically suggest: instead of economic sluggishness fueling anti-establishment sentiments, it is the rise of Euroskepticism that may actively contribute to economic stagnation.

Here are some initial thoughts from a non-European perspective, so keep that in mind as you read.

Firstly, the authors’ argument seems to adopt an “either-or” perspective by opposing the common view that economic decline leads to anti-establishment voting. I suspect the reality is more nuanced, involving complex interactions. In areas of economic decline, younger residents may migrate in search of better opportunities, leaving behind an older, more conservative population. Investors typically favor regions with growing demographics and a younger workforce due to lower labor costs, suggesting that demographic trends may be more significant than voting patterns.

Secondly, there are instances where resisting economic growth can pay off in the long term. For example, Portland, Maine, declined a chance to become a major Ford manufacturing hub in the 1930s because local leaders wanted to preserve the area’s culture. As a result, Maine remained rural and impoverished. However, this choice now seems fortuitous, as Portland is arguably better positioned today than Detroit, which was once the richest city in the U.S. but has since faced significant decline.

Lastly, I have questions regarding the classification of Euroskepticism. The article mentions Greece’s Syriza party as a case in point. While Syriza’s messaging has evolved, it originally came to power on the premise that it could negotiate better bailout terms than previous governments, positioning itself as an anti-establishment alternative. It’s worth noting that it was the IMF, not the EU, that formulated and implemented the austerity measures, affecting numerous non-EU countries as well. In 2020, the IMF reported that over half of the world’s nations requested assistance. Although most funds for Greece came from EU member states, the IMF played a vital role in overseeing these bailouts and ensuring compliance with austerity measures.

During the height of the negotiations, I observed that few who sympathized with Greece recognized that the situation had become dire just weeks after Syriza took office. The government signed a “memorandum” for a critical mini-bailout, committing to another IMF program, with finer details to be established later.

Importantly, neither Syriza nor the Greek populace was anti-EU in 2015; they were specifically opposed to the IMF. A July 2015 article noted that while many advocates for Greece’s self-determination suggested a Grexit, this conflicted with the preferences of Syriza’s leadership and the general public. A Bloomberg poll found that 81% of Greeks favored remaining in the Eurozone, recognizing that the hardships of austerity were preferable to the chaos a Grexit could trigger.

Now, let’s delve into the main discussion.

By Andrés Rodríguez-Pose, Princesa de Asturias Chair and Professor of Economic Geography, London School of Economics and Political Science, Lewis Dijkstra, Urban and Head of the Territorial Analysis Team, Joint Research Centre, European Commission, and Chiara Dorati. Originally published at VoxEU

Support for Euroskeptic parties has surged from the fringes to encompass nearly a third of European voters. These movements promise a ‘free lunch’: prosperity through less integration and more national control. Our new evidence from 1,166 European regions from 2004 to 2023 shows that Euroskepticism carries significant economic costs. Regions exhibiting Euroskeptic tendencies have experienced slower GDP per capita, productivity, and job growth, particularly since the euro area crisis. Far from enabling local economies, Euroskepticism has provably adverse economic impacts, creating a cycle of discontent and decline.

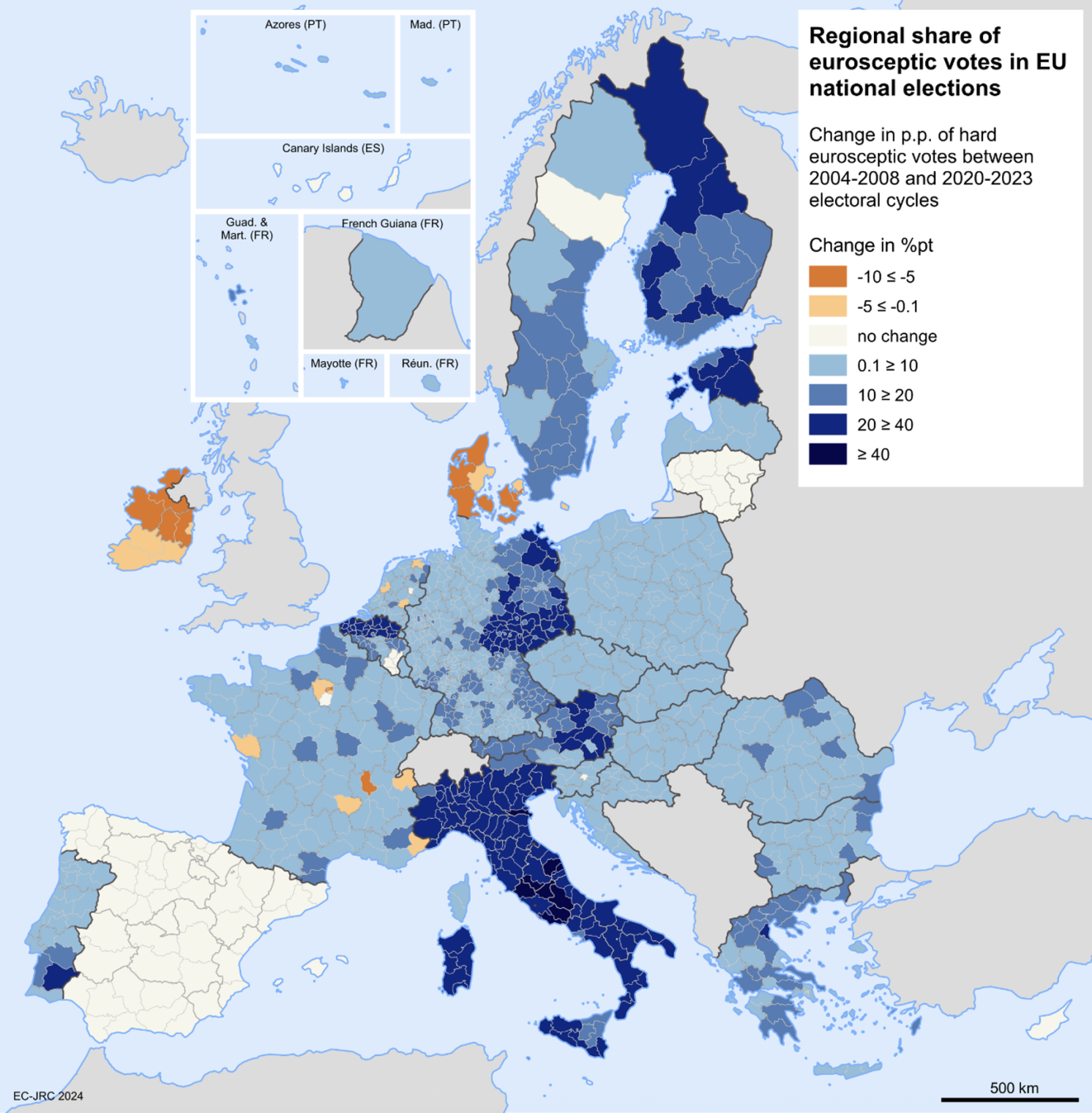

In less than two decades, Euroskepticism has shifted from the periphery to the core of European politics. Once relegated to populist movements—capturing merely 3.7% of votes in national elections during the mid-2000s—parties advocating for national control now command up to a third of the electorate across EU member states. In some regions, Euroskeptic factions garner support from over half of voters, reshaping electoral landscapes from the Po Valley to eastern Germany and rural Sweden (Figure 1). The narrative is a compelling one: European integration is a barrier to prosperity, and reclaiming ‘sovereignty’ will restore economic vitality.

Figure 1 Change in the regional share of votes for hard Euroskeptic parties in EU national legislative elections, 2004–2008 vs. 2020–2023 electoral cycles

Source: Authors’ elaboration.

Our research (Rodríguez-Pose et al., 2025) investigates the ramifications of the rise of Euroskepticism, directly challenging the prevailing assumptions. Utilizing regional data from all 27 EU countries from 2004 to 2023, we sought to understand the economic consequences for regions turning against European integration. Our analysis reveals that regions embracing Euroskepticism have, over time, recorded slower economic growth, fewer job opportunities, and diminished productivity when compared to their more Europhile counterparts. In essence, Euroskepticism does not offer a free lunch; rather, it serves as a contributor to socio-economic malaise.

Beyond the Causes of Euroskepticism

Most prior economic studies have focused on the roots of Euroskepticism, viewing it as a reaction to economic hardship. The notion that prolonged economic suffering can provoke political backlash (Rodríguez-Pose, 2018) has been fundamental in understanding its ascent. The geography of discontent within the EU closely mirrors areas experiencing long-term stagnation (Dijkstra et al., 2020). Furthermore, a strong correlation exists between external economic pressures, such as increased competition from imports, and anti-EU sentiment (Stanig and Colantone, 2017).

However, this research only explores one facet of the issue. What happens to local economies once voters support Euroskeptic parties, even if these parties are not in government? Can political dissatisfaction itself become an economic burden, even before Euroskeptic policies are enacted?

No prior research has directly addressed the consequences of Euroskepticism. The closest parallels come from studies on populism, revealing that anti-establishment leaders globally often result in poorer economic outcomes, with GDP per capita about 10% lower 15 years post-election (Funke et al., 2023). This research suggests that populist leadership often leads to diminished performance due to institutional erosion and policy mismanagement (Funke et al., 2023).

Yet, populism does not equate to Euroskepticism, as many Euroskeptic parties in Europe have seldom held governmental power. While some, like Fratelli d’Italia in Italy or Fidesz in Hungary, are in power currently, numerous others—such as Rassemblement National in France or Alternative für Deutschland in Germany—remain in opposition. Thus, we must consider: can the mere signal of widespread Euroskepticism hinder regional economic prospects?

The ‘Free Lunch’ Fallacy

Euroskeptic parties, spanning the political spectrum, pledge revitalization through liberation from EU oversight. For right-leaning factions, it means enhancing national competitiveness stripped of EU regulations; for left-wing parties, it signifies freedom from austerity and financial constraints. Both perspectives share the belief that regaining sovereignty will translate into renewed prosperity.

Has this been realized? Our extensive dataset encompasses 1,166 European regions across all EU-27 nations from 2004 to 2023. We gauge Euroskeptic support using the electoral shares of parties mainly opposing European integration. Our analysis monitors the performance of these regions against four key developmental metrics: GDP per capita, productivity, job creation, and population change.

The results indicate that a 10-point increase in Euroskeptic voting correlates with approximately a 0.35 percentage point decline in annual GDP per capita growth. While this may seem minor, the compounded effect over multiple electoral cycles leads to significant divergence. Over a span of 12 years—three electoral cycles—regions with higher Euroskeptic support could find themselves about 4%–5% poorer than similar regions with less Euroskeptic sentiment.

Productivity trends reflect a similar narrative. Each additional 10 percentage points of Euroskeptic backing corresponds with an annual reduction in productivity growth of approximately 0.10–0.14 percentage points. Employment creation lags by about 0.25 percentage points yearly, equating to roughly 3% fewer jobs over the same period. Although population trends are somewhat less pronounced, Euroskeptic regions struggle to hold onto or attract residents. The robust and substantial relationship between Euroskeptic attitudes and ensuing economic underperformance is evident.

The Crisis as a Turning Point

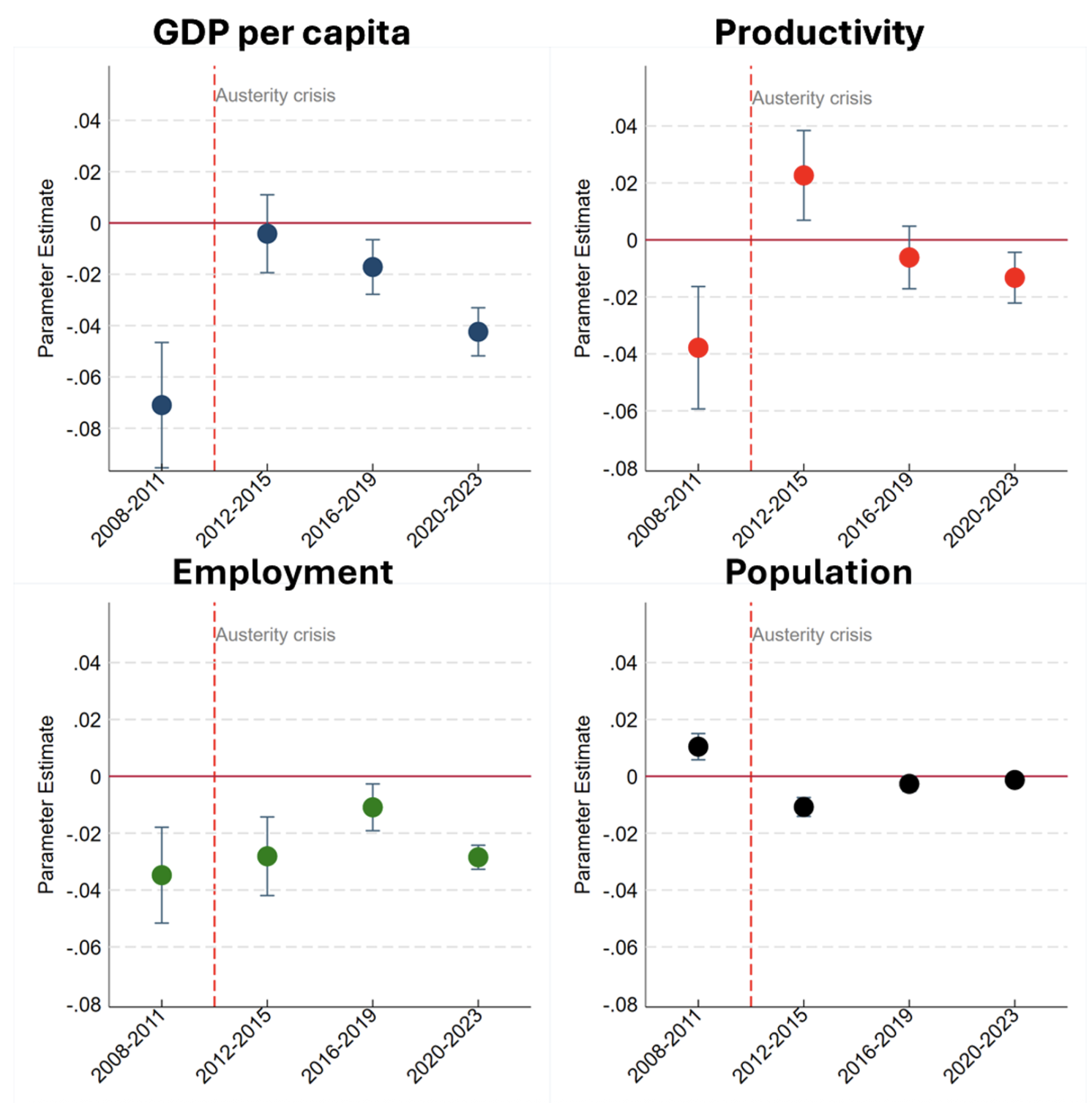

The euro area crisis of 2012–2013 and the subsequent austerity measures marked a pivotal moment. Before the crisis, the associated economic penalties of Euroskepticism were present but less pronounced. The crisis fundamentally altered the landscape: regions with high Euroskeptic leanings were particularly hard-hit during and after this period.

Post-2012, the GDP per capita penalties nearly doubled compared to the pre-crisis period. Regions increasingly Euroskeptic experienced annual growth rates falling by an additional 0.16 percentage points post-2012, leading to an overall total of approximately 0.38 percentage points annually. By 2023, this had culminated in a cumulative income shortfall nearing 5.5% (Figure 2).

Figure 2 Development implications of Euroskeptic support and the crisis (event study analysis)

Note: The horizontal axis indicates the period following the electoral cycle.

What accounts for the amplified economic repercussions of Euroskepticism during the crisis? Several mechanisms likely played a role. Firstly, regions vocally opposed to the EU may struggle more with securing or effectively using European funds. Research by Crescenzi et al. (2020) suggests that EU funding can alleviate rather than exacerbate Euroskeptic sentiments when allocated effectively. However, this requires institutional capacity and willingness to work within EU frameworks—qualities often lacking in Euroskeptic regions (Rodríguez-Pose et al., 2024). Investors faced with limited capital post-crisis may avoid regions perceived as politically unstable or hostile to EU structures. Additionally, the crisis heightened regional polarization; areas with strong Euroskeptic leanings may have seen decreased social cohesion and institutional trust at a time when collaboration for recovery was crucial.

Not Just About Seizing Power

Significantly, these adverse effects manifest largely without Euroskeptic parties holding power. Despite their swift ascent, most have remained in opposition, with exceptions including Syriza in Greece, Hungary’s Fidesz governance, or various Italian Euroskeptic parties. Consequently, the economic penalties appear to operate through channels other than direct policy implementation.

High Euroskeptic vote shares may signal institutional distrust and political uncertainty to businesses and investors. When investors sense approaches hostile to the EU or uncertainty around EU relations, capital flows recede, businesses hesitate to invest, and national investment funds may remain underutilized or misallocated.

The political act of rejecting integration seems to carry economic consequences even before it translates into specific policy changes. Firms considering investment may pause when local electorates express hostility toward EU frameworks, which support the single market. Even absent policy shifts, widespread Euroskeptic sentiments can deter investments and raise perceived risks. The case of Brexit exemplifies how political uncertainty can stifle economic activity long before real withdrawal occurs (van Oort et al., 2017). Such uncertainty can echo through regional economies even before Euroskeptic leaders assume power.

Local leaders in highly Euroskeptic regions may also alter their strategies in response to robust anti-EU sentiment, leading to diminished engagement with EU programs, European cooperation efforts, or business development initiatives, even if the leaders themselves aren’t from Euroskeptic parties. The cumulative impact of these micro-decisions can substantially reshape growth trajectories.

A Vicious Cycle

This research reveals a concerning feedback loop. Economic stagnation and regional decline invigorate Euroskeptic voting, as supported by studies on Europe’s “development trap” (Diemer et al., 2022, Rodríguez-Pose et al., 2024). Numerous European regions are caught in a cycle of persistent low growth, unable to adapt to structural economic shifts (Iammarino et al., 2020). Our findings indicate that Euroskeptic sentiment becomes part of the problem, not merely a symptom, as regions exhibiting Euroskepticism experience diminished economic dynamism, further exacerbating discontent and potentially fueling heightened Euroskeptic support in future elections.

This dynamic creates a particularly insidious form of path dependence. Voters in struggling regions turn to Euroskeptic parties seeking change and prosperity. However, their choices—albeit understandable in the face of their frustrations—often exacerbate their economic outlook, intensifying the stagnation that initially fueled their protest voting. The promised “free lunch” of diminished EU integration as a pathway to economic recovery proves to be illusory. Ultimately, citizens in Euroskeptic regions seem to pay the cost of their political discontent through lost opportunities and stunted growth.

Breaking the Cycle

The implications for policy are profound. The answer isn’t to dismiss Euroskeptic voters, whose concerns are frequently valid, but to acknowledge the economic toll of addressing those concerns through anti-European politics. Labeling residents of these regions as “deplorables,” as Hillary Clinton did during her unsuccessful 2016 presidential campaign, or designating these areas as lost causes only deepens their alienation (Rodríguez-Pose, 2018). Simple financial transfers are not enough (Borin et al., 2021). Funding without genuine engagement may mitigate symptoms but will not cure the underlying issues. Regions and populations left behind require authentic political re-engagement alongside targeted economic reinvestment.

A dual approach seems necessary. Politically, the EU and national governments should listen to and address concerns regarding fairness, representation, and local autonomy that drive Euroskepticism. Economically, focused initiatives that promote regional development, educational opportunities, access to funding, and economic diversification are crucial. Recent EU efforts, like the collaborative recovery fund and an emphasis on a “just transition” in climate policy, signify positive strides but must distinctly target vulnerable regions to be effective.

Above all else, humility is vital. Many voters gravitated towards Euroskeptic parties due to prolonged neglect from mainstream politics. Yet this choice arguably worsened their economic circumstances, presenting an irony that merits reflection. The challenge lies not only with voters or institutions but in mending their fractured relationship. Restoring trust in democratic processes, including the EU’s ability to foster widespread prosperity, remains essential.

Ultimately, the quality of governance and institutions is crucial. Enhancements in local governance prove more decisive for growth than mere investment in physical assets (Rodríguez-Pose and Ketterer, 2019). Where local administrations are transparent, accountable, and efficient, EU funding results in tangible development; where these qualities are absent, cynicism endures. Only by fostering a virtuous cycle of competent governance can we break the cycle of discontent.

Conclusion

Euroskepticism does not offer a free lunch. Its rise carries economic consequences that disproportionately impact those who anticipated benefiting from it. The future of Europe relies on avoiding the entrenchment of Euroskepticism as a barrier to economic progress across the continent. This challenge calls for more than superficial comments on unity or technical adjustments to cohesion policy. It necessitates responsive governance aimed at transforming today’s Euroskeptic bastions into future success stories, reintegrating disenfranchised citizens into a more prosperous and unified Europe. The alternative—allowing the cycle of discontent and decline to persist—threatens to weaken the European project region by region, vote by vote.

See original post for references