Why Toast Stock is Gaining Attention Again

Toast (TOST) is once again in the spotlight following the introduction of new AI-driven tools designed for catalog management, pricing, and marketing. These innovations aim to reestablish Toast as a comprehensive retail operating system.

This transformation, alongside a recent upgrade from analysts and a resurgence in investors’ appetite for technology stocks, has placed Toast back on many watchlists as market participants reevaluate its current valuation.

See our latest analysis for Toast.

Currently, Toast’s stock shows a 1-day price decrease of 1.2% and a 30-day decline of 7.37%. However, it has a notable 1-year total shareholder return of 14.06% decline, though it boasts a 48.44% gain over the last three years. This indicates a cooling of recent momentum, despite the renewed interest in Toast’s AI initiatives, executive transitions, and the upcoming earnings report.

If Toast’s AI advancements intrigue you, consider expanding your research to include other high-growth tech and AI stocks that are innovating the intersection of software and real-world business applications.

With Toast’s shares priced at US$33.80, the stock is currently 37.9% below the average analyst price target, while its intrinsic value estimation suggests a potential upside of approximately 9.7% from today’s valuation. This raises the question: Is there real growth potential here, or has the market already factored in future advancements?

Most Popular Valuation Insight: 29.2% Below Fair Value

The most common valuation assessment places Toast’s fair value around $47.75, significantly higher than its last closing price of $33.80. This creates a notable gap that the market narrative aims to clarify.

Expansion into new market segments—such as enterprise chains, food and beverage retail, and international markets like Australia—is anticipated to generate diverse, rapidly growing high-ARPU customer streams, promoting top-line growth and enhancing earnings stability.

What kind of revenue growth, margin improvements, and future earnings multiples support this fair value? The full narrative outlines an ambitious earnings trajectory that combines rising profitability and a premium price-to-earnings (P/E) ratio necessary to justify a valuation of $47.75.

Projection: Fair Value of $47.75 (UNDERVALUED)

Explore the full narrative to delve deeper into the underlying forecasts.

However, this projection depends on Toast effectively managing hardware costs and tariffs while navigating competitive pressures that might impact average revenue per user (ARPU) and margins.

Learn about the key risks related to this Toast narrative.

An Alternative Perspective: The Cost of Toast Today

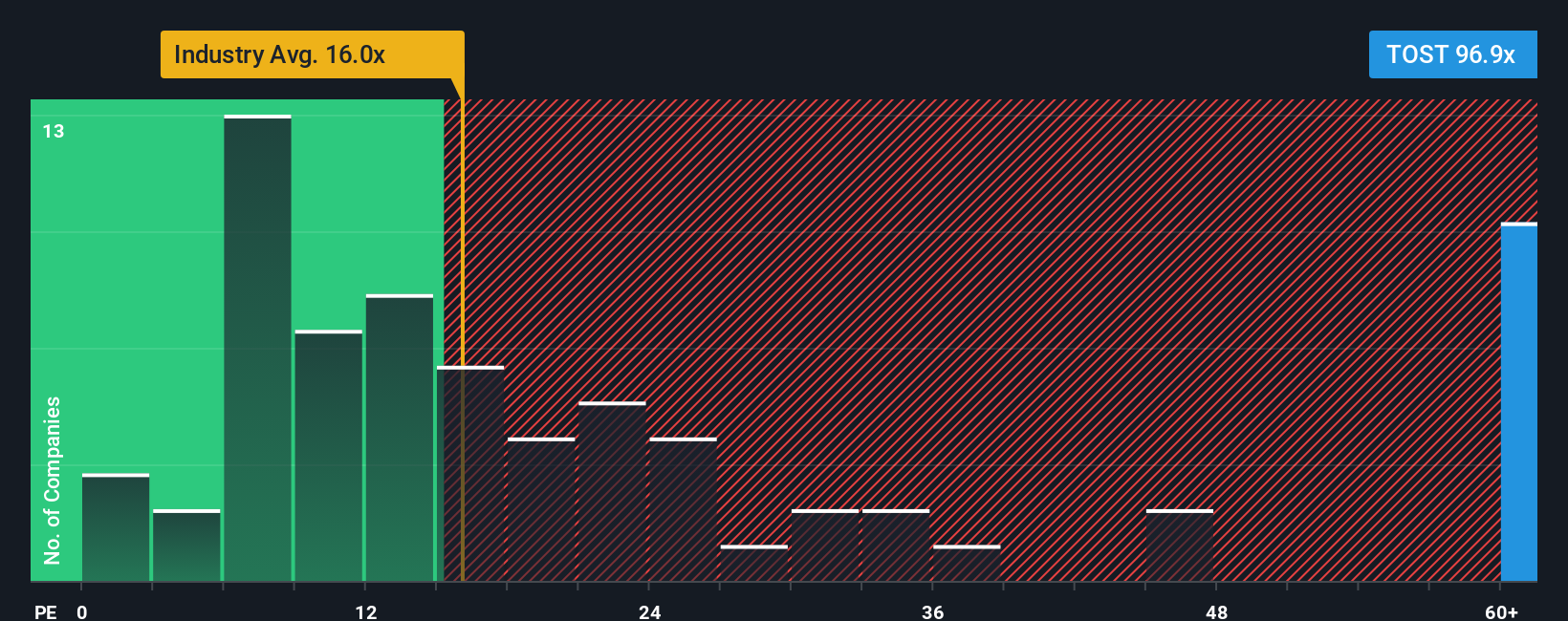

The initial narrative emphasizes future earnings and a premium P/E ratio to assert that Toast is undervalued by 29.2%. However, the current P/E stands at 72.8x, which presents a stark contrast to the fair P/E ratio of 22x, a peer average of 40.8x, and a sector average of 14.5x. This discrepancy suggests that investors are already paying a considerable premium, inviting questions about how comfortable one might feel with such embedded optimism.

Examine the numbers for this pricing via our valuation analysis.

Create Your Own Perspective on Toast

If certain aspects of this narrative don’t resonate with you, or if you’d prefer to analyze the raw data independently, you can easily create your own understanding of Toast in just a few minutes using your own tailored approach.

A solid foundation for your Toast research can be found in our analysis, which outlines two key opportunities and one significant risk that could influence your investment choices.

Seeking More Investment Opportunities?

Should Toast be on your investment radar, consider broadening your search across various sectors to uncover additional opportunities you might overlook.

This article by Simply Wall St serves as a general resource. We provide insights based on historical information and analyst projections using an unbiased methodology; however, it does not constitute financial advice. It is not intended as a recommendation to buy or sell any stock and does not consider your financial goals or situation. Our focus is to deliver long-term analysis guided by fundamental data, although our assessments may not include the latest price-sensitive announcements or qualitative information. Simply Wall St does not hold any positions in the stocks discussed.

Understanding Valuation

Explore whether Toast might be undervalued or overvalued with our in-depth analysis, which includes fair value estimates, potential risks, dividends, insider trading, and overall financial health.

Have thoughts on this article? Concerned about its content? Contact us directly to share your views. Alternatively, email editorial-team@simplywallst.com