In the context of modern economic systems, significant monetary intervention often leads to distortions that create a disconnect between financial markets and the real economy. While efforts to stimulate economic growth can superficially boost financial markets, they frequently result in inflationary imbalances that further separate market performance from economic reality.

Investment guru Jeremy Grantham has expressed his astonishment at the current state of the stock market bubble, stating that investing in U.S. equities is akin to “playing with fire.” His assessment highlights the precarious nature of today’s financial environment.

Tracing these issues back to their roots reveals the influence of the Federal Reserve, which has been a pivotal force in inflating this bubble over several decades.

For instance, following the 1987 Black Monday crash, Alan Greenspan initiated what became known as the “Greenspan put.” Financial markets were well-prepared for this intervention, as interest rates had peaked in 1981, leaving ample room for reduction. At that time, the yield on the 10-Year Treasury note hovered around 9 percent, indicating available opportunities for lower borrowing costs.

The workings of the Greenspan put are straightforward: when the stock market experiences a significant drop, such as the 20 percent decline seen recently, the Fed will typically respond by lowering the federal funds rate. This action leads to negative real yields and a surge in available credit.

This approach has two primary consequences for market dynamics. First, the influx of liquidity creates a safety net that cushions the stock market against steep declines, akin to a put option. Second, reducing interest rates leads to rising bond prices, as these move inversely to interest rates.

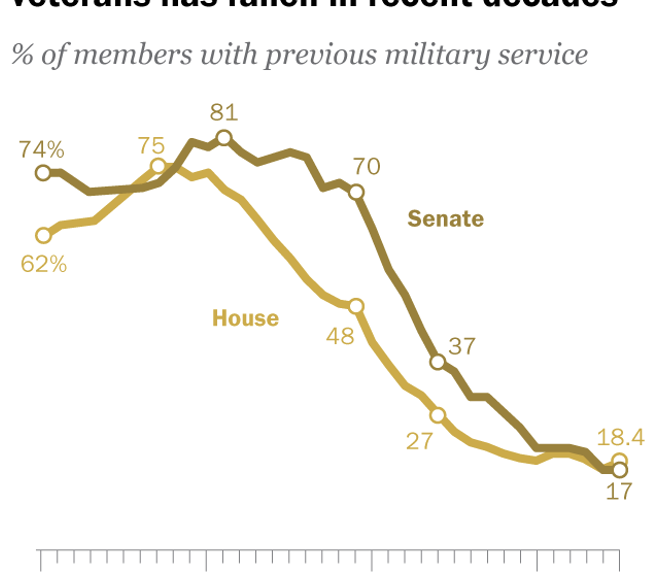

Thanks to the Greenspan put, the Fed has implicitly implemented counter-cyclical policies to stimulate the stock market since the late 1980s. Successive Fed leaders—Ben Bernanke, Janet Yellen, and Jay Powell—have amplified this intervention through numerous money-printing programs.

The motive behind these monetary measures is primarily to support large banks and corporations, ensuring that financial markets remain buoyant and that the government has access to affordable credit. Today, it’s evident that U.S. financial markets have been manipulated for over three decades, and a return to normalcy seems increasingly elusive.

Once fundamental changes occur in a system, they are often irreversible. Distortions created by these monetary policies will leave lasting impacts, often burdening innocent individuals who suffer from the fallout of reckless decisions.

To illustrate this point, consider the story of Olive Oatman:

Olive Oatman

In 1851, a thirteen-year-old Olive Oatman crossed what is now western Arizona with her family when tragedy struck, and they were attacked by Yavapai Indians. Her parents and four siblings lost their lives, while her brother Lorenzo was rendered unconscious and abandoned.

Olive and her younger sister, Mary Ann, were taken captive. A year later, the Yavapai traded them to the Mohave tribe, where Mary Ann succumbed to starvation. Olive, however, adapted and integrated into Mohave life.

In 1856, five years after the Oatman massacre, Olive was ransomed back to white society. During her time with the Mohave, she was marked with a tattoo on her chin using cactus ink, a sign of her assimilation that was intended to promise her a favorable afterlife.

Unfortunately, the tattoo left a permanent mark on Olive’s life; she spent years hiding her disfigurement with makeup and veils. She passed away in 1903 after enduring 47 years with this visible reminder of her past.

Shortly after Olive’s death, Oatman, Arizona, emerged as a town named in her honor. Following the discovery of a rich vein of ore, the area experienced one of the last gold rushes in the desert, with the mines becoming a significant gold source for about a decade until their closure in 1924.

Despite a decline in gold mining, Oatman thrived as a stop for travelers on Route 66 until the construction of Interstate 40 rendered it obsolete.

America’s Guaranteed Living Hell

Today, Oatman stands as a well-preserved ghost town. Wild burros, descendants of the miners’ pack animals, roam the streets. The haunted Oatman Hotel hosts the spirits of famous figures like Clark Gable and Carole Lombard, who spent their wedding night there, along with the ghost of a bagpiping Irish miner known as “Oatie.”

Recently, on a journey to Sedona, surrounded by the stunning landscapes of red rocks and lush pine forests, we stopped in Oatman to absorb its unique atmosphere. While enjoying bottled sarsaparilla outside the Oatman General Store, our thoughts drifted to the Federal Reserve’s flawed monetary practices and their far-reaching effects.

This past week, the Fed announced plans to purchase individual corporate bonds as part of a new initiative dubbed the Secondary Market Corporate Credit Facility (SMCCF). Initially funded with $75 billion from the Treasury as part of the CARES Act, the SMCCF had focused on acquiring exchange-traded funds (ETFs). Now, the Fed intends to target specific corporate bonds to support struggling U.S. companies. According to the Fed’s statement:

“The SMCCF will purchase corporate bonds to create a portfolio based on a broad, diversified market index of U.S. corporate bonds that meet specified criteria. This indexing approach will complement the facility’s existing ETF purchases.”

Through its bond-buying initiatives, the Fed is inflicting irreversible damage on the economy. By propping up companies that should face bankruptcy, it misallocates financial resources that could otherwise find more productive uses.

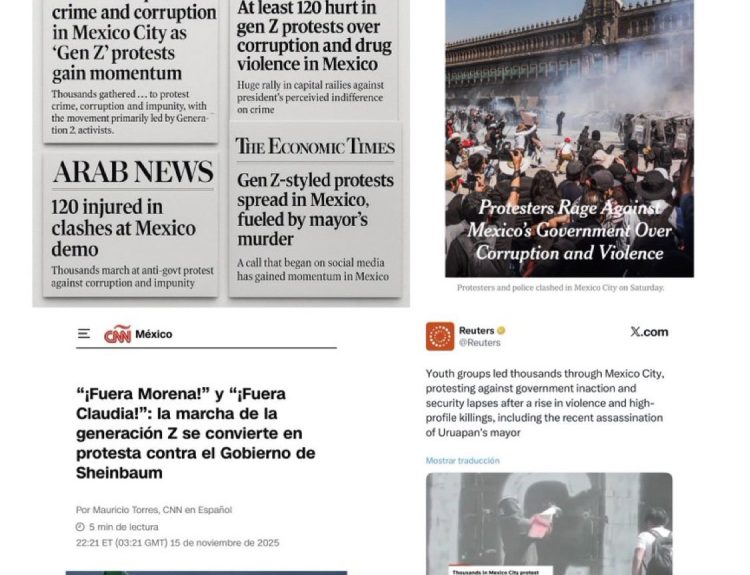

This not only exacerbates wealth disparity and income inequality but also fuels civil unrest and deepens financial instability.

It’s crucial to recognize that certain actions create irreversible changes. Distortions fueled by such interventions often leave lasting scars.

While Olive Oatman lived with the hope that her disfigurement would secure her a favorable afterlife, the disfigurements brought about by today’s monetary policies may only guarantee an increasingly chaotic America.

Sincerely,

MN Gordon

for Economic Prism

Return from America’s Guaranteed Living Hell to Economic Prism