Gold’s Upcoming Surge Linked to Institutional Demand

Ryan McIntyre from Sprott believes that the future increase in gold prices will be fueled primarily by the growing demand from institutional investors. In times of economic uncertainty, these investors are increasingly turning to gold as a reliable store of value.

The Shift in Market Dynamics

Historically, individual investors have dominated the gold market. However, a noticeable shift is occurring as more institutions recognize the benefits of including gold in their investment portfolios. This transition is expected to create significant upward pressure on gold prices.

Factors Driving Institutional Interest

- Inflation Hedge: With rising inflation rates, institutions are looking for assets that can protect their purchasing power, making gold an attractive option.

- Portfolio Diversification: Gold provides excellent diversification benefits, helping to mitigate risks associated with volatility in other asset classes.

- Geopolitical Concerns: Ongoing geopolitical tensions encourage investors to seek safe-haven assets, like gold, to safeguard their investments.

Future Outlook

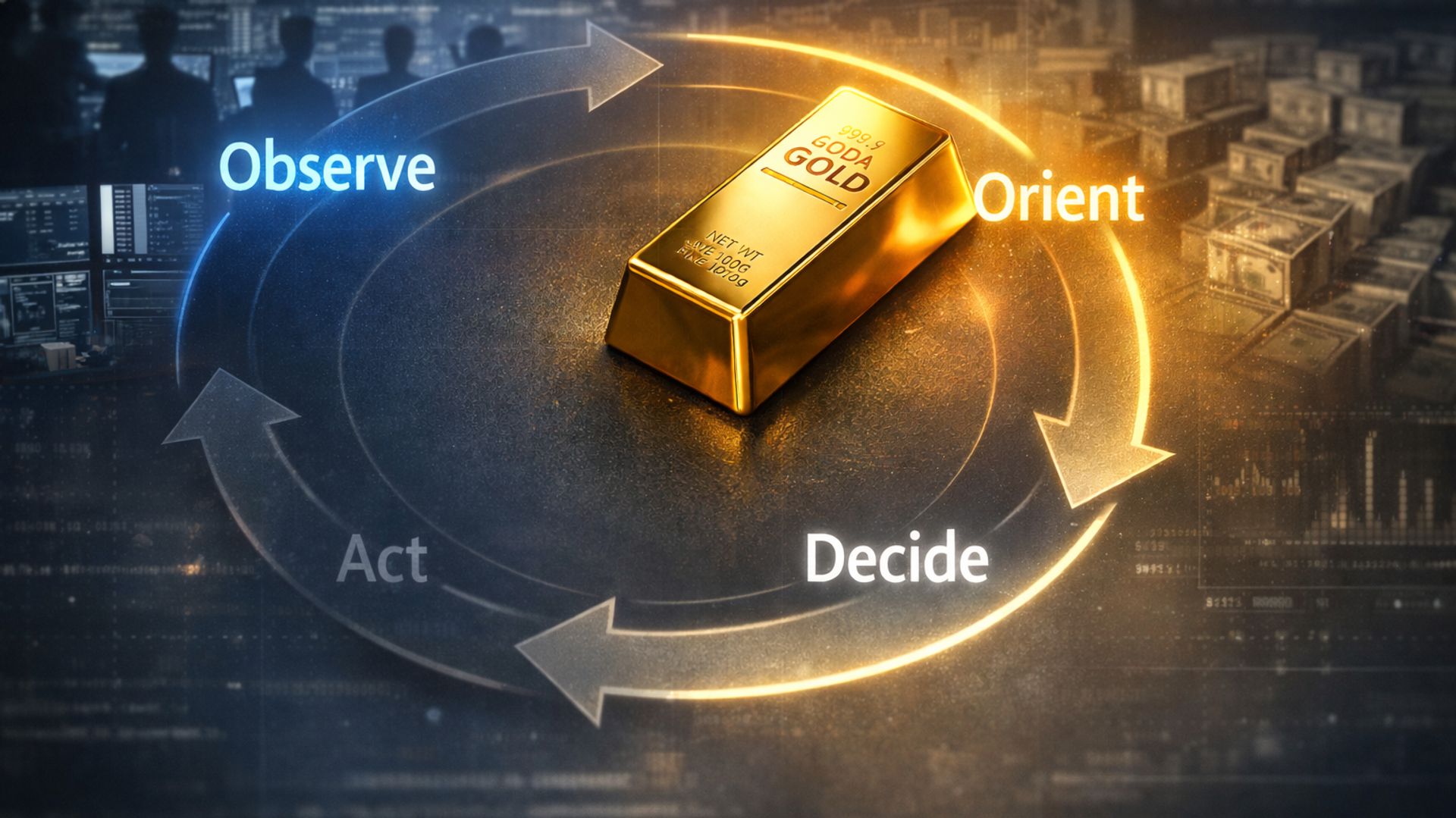

McIntyre emphasizes that as institutional demand continues to increase, we can expect gold prices to respond positively. The combination of economic pressures and strategic investment choices makes this a promising period for gold in the financial markets.

Conclusion

In summary, the anticipated rise in gold prices will largely be driven by heightened institutional demand. As these investors increasingly seek refuge in gold during uncertain times, the precious metal may see a notable appreciation in value. Now is a crucial time for both investors and analysts to closely monitor these trends.