In a recent development regarding rental practices and antitrust laws, questions have arisen surrounding the U.S. Department of Justice’s (DOJ) recent settlement with RealPage and the implications for rental prices across the nation. This article explores the ramifications of this settlement and its broader impact on tenants and the housing market.

Last week, we discussed a settlement involving nine states and the largest landlord in the U.S., Greystar, raising concerns about the DOJ’s civil case against RealPage:

Some speculate that the lenient justice department settlements with major landlords, including Greystar and Cortland, might indicate significant consequences for RealPage. I remain skeptical, as it seems more like initial steps to cover up extensive wrongdoing.

As the situation develops, the stakes have grown significantly. Just before Thanksgiving, the DOJ revealed that it would settle its civil case with RealPage in a holiday announcement.

To summarize, Greystar and other large landlords utilized software from the Texas-based private equity firm RealPage to gather real-time data on pricing and supply, leveraging this information to set unit-specific prices and maximize their profits at the expense of American renters.

Previously in December, the DOJ closed its criminal investigation into RealPage. In August, Greystar settled with the DOJ, admitting no wrongdoing and facing no substantial fines. Many states reached comparable settlements with prominent landlords, including Cortland, who also used RealPage as a facilitator for price-fixing. These settlements included minimal fines but hinted that these institutions could potentially be forced to abandon RealPage’s collusion software.

However, as noted last week, the parameters imposed on mega landlords—many of which are private equity-owned and reliant on RealPage’s software—are contingent on the final judgment from the DOJ regarding RealPage.

This effectively hinges on the Trump DOJ’s lawsuit against the company. The DOJ’s response suggests a permissive environment for large landlords at the expense of ordinary renters.

Matt Stoller commented on the case outcomes, including a peculiar interaction with DOJ Antitrust Chief Gail Slater on social media. His insights highlight how only minor adjustments may allow landlords and RealPage to continue their exploitative practices:

The settlement involves “complex behavioral remedies,” which historically have been poorly enforced and filled with loopholes. For example, while RealPage can’t offer the same “synthetic curve” to multiple clients as a form of price-fixing, there’s nothing stopping it from tweaking the curve slightly. Detecting violations under these circumstances would be incredibly challenging, making enforcement practically impossible. The company knows this settlement won’t be scrutinized thoroughly.

RealPage apparently intends to maintain its current business model. The company stated the following regarding the settlement:

This settlement ensures housing providers and technology innovators can operate revenue management software confidently, aligning with the perspectives of federal antitrust enforcers…

The arrangement demonstrates RealPage’s commitment to compliance and innovation, ensuring its products continue to benefit both property owners and their tenants.

-

No findings or admissions of liability: The agreement carries no financial penalties, damages, or admissions of wrongdoing.

-

Continuity for customers: There won’t be disruptions to customer operations. All RealPage solutions remain fully available and compliant with evolving legal requirements.

-

Formalizing product modifications: The settlement essentially recognizes modifications RealPage has already implemented over the past year concerning its revenue management solutions.

-

Independent oversight: RealPage has agreed to an independent monitor to validate ongoing compliance, reflecting confidence in their integrity and commitment to responsible operations.

Here are a few critical observations:

-

- The assertion that RealPage’s software benefits residents is absurd and contradicts statements from company representatives and users.

For example, executive Andrew Bowen boasted that the software had driven price hikes. He noted: “As a property manager, very few of us would manually raise rents by double digits within a month.”

As previously detailed, there is considerable evidence suggesting that RealPage and its collusive software have significantly contributed to America’s growing homelessness crisis.

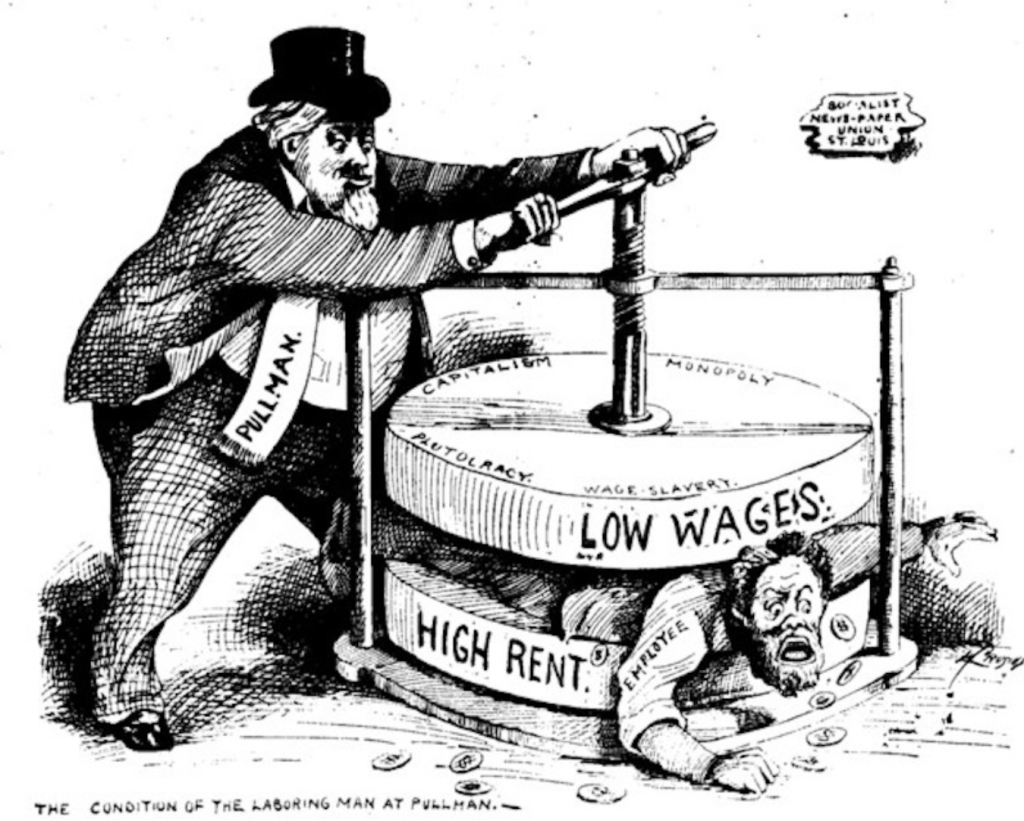

“The Condition of Laboring Man at Pullman,” political cartoon from Chicago Labor Newspaper, July 7, 1894, which highlights the plight of working Americans today. Image: Wikimedia Commons.

2. “Continuity for customers” signifies endorsement of ongoing illegal activity now sanctioned by the DOJ. Let’s review:

An Associate Vice President from one of the defendants promoted the collusionary nature of the software, as reflected in RealPage’s own materials:

With LRO [RealPage’s Lease-Rent Options], we rarely make overrides to pricing recommendations. Even though we’re technically competitors, LRO facilitates collaboration for successful pricing strategies.

RealPage’s “recommendations” function as a form of price-fixing:

To ensure compliance with these “recommendations,” RealPage exerts notable “pressure” on landlords to adopt its prices, tracking who requests deviations. Consequently, landlords complying with RealPage’s recommendations do so 80-90% of the time.

Furthermore, a joint legal brief from March 2024 by the DOJ and FTC states that even without additional pressure, these types of algorithm-based recommendations are illegal:

It is inherently illegal for competing landlords to jointly delegate critical pricing functions to a common algorithm, even if landlords retain some capacity to deviate from the algorithm’s guidance. Full adherence to a price-fixing scheme is not necessary for its effectiveness to be rendered illegal.

3. “The settlement practically commits RealPage to modifications it has already implemented over the past year.” This likely refers to a tool that allows clients to opt out of non-public competitor data when generating rent “recommendations.”

Yet, this raises significant concerns, as highlighted by Stoller:

RealPage retains its pricing advisors who guide landlords on setting charges. The only modification is that broader meetings are prohibited; one-on-one discussions are permitted as long as they rely on public data. How can a pricing advisor restrict discussions solely to public or client data? If a landlord asks about increasing rents and the advisor recently spoke with another landlord raised prices, what guidance can they offer? This settlement is bound to be violated.

Collectively, it appears that Thoma Bravo likely negotiated a favorable settlement with the Trump administration. The Wall Street Journal previously discussed how large corporate lobbying is yielding favorable outcomes for antitrust violations. Here’s an excerpt featuring relevant details regarding RealPage:

Several corporations facing antitrust scrutiny are now seeking to hire lobbyists tied to Trump after observing favorable settlements such as that with HPE. Thoma Bravo, a private equity group managing a company embroiled in multiple antitrust lawsuits, has hired [Brian Ballard—an ally of Trump who gathered $50 million for his 2024 campaign] to address competition issues in the real estate sector. Last year, the DOJ litigated against RealPage, asserting that the firm’s rent-setting software enabled landlords to collude on price increases.

And now we find ourselves in this situation.

The nine states co-plaintiffs with the Antitrust Division against RealPage did not endorse the settlement, but is there a glimmer of hope there?

These states (California, Colorado, Connecticut, Illinois, Massachusetts, Minnesota, North Carolina, Oregon, and Tennessee) recently negotiated a notable $7 million settlement from Greystar.

In the same settlement, they allowed room for Greystar to keep utilizing RealPage software based on the DOJ’s decision. Here’s a key excerpt:

Greystar may license or use a Revenue Management Product in a Settling State complying with the agreed Final Judgment between the United States and RealPage in United States et al. v. RealPage et al… For clarity, if only a RealPage-U.S. Final Judgment (not a RealPage-Settling States-Final Judgment) is recorded by January 5, 2026, Greystar may use a Revenue Management Product adhering to that RealPage-U.S. Final Judgment.

It appears that the DOJ’s enforcement actions against RealPage lacked any substantial weight, allowing the nation’s largest landlord and its collaborators to persist with updated collusive practices. It’s evident that the billionaires who supported Trump gained significant advantage by pushing to oust Lina Khan and Jonathan Kanter from the Federal Trade Commission and the DOJ Antitrust Division, respectively—this assumption also posits that a Kamala Harris administration would not necessarily offer better outcomes since she, too, has catered to the interests of the wealthy, demonstrating reluctance to maintain Khan’s position.

Rather than facing consequences from the DOJ settlement, RealPage seems to have gained confidence. Fresh off its advantageous agreement, the company is asserting its role in promoting the narrative equating illegal activities of the affluent with free speech:

Price gouging Americans on essential goods as a form of corporate First Amendment right illustrates a corrupt oligarchy, where billionaires purchase elections to dominate democracy. https://t.co/cXBFk1K5aU

— Melanie D’Arrigo (@DarrigoMelanie) November 26, 2025

In addition, RealPage has initiated litigation against Berkeley, California, over an ordinance prohibiting landlords from implementing AI-driven pricing algorithms to determine residential rents.

The company is also accelerating efforts involving surveillance pricing and artificial intelligence. Recently, RealPage acquired Livble, a service facilitating monthly rent payments in installments. According to The Verge:

Livble promotes itself as a “flexible” rent payment solution, permitting renters to split payments across four installments monthly. The service asserts it aids tenants in “avoiding late fees and credit card charges” while helping “build credit through rent,” albeit charging $30 to $40 per loan. Under this arrangement, RealPage will integrate Livble into its property management system and oversee “all collections.”

But Livble’s offerings extend beyond just payment solutions:

“In underwriting tenants requesting to split their rent payments, Livble accesses Plaid’s open banking data.”

Plaid offers an application aimed at giving users greater control over their financial information while primarily facilitating consent for sharing banking data with third parties. pic.twitter.com/FJJWVE0GJz

— Lee Hepner (@LeeHepner) July 28, 2025

Moreover, RealPage has recently launched its Lumina AI Workforce, highlighting “intelligent AI agents” intended to streamline tasks across leasing, operations, facilities, finance, and resident engagement.

We are rapidly approaching a scenario in which housing is increasingly governed by Wall Street interests using software that aligns pricing strategies while accessing personal financial data, with decisions leaning more toward AI. The DOJ’s response indicates that this is acceptable.