“The LORD sends poverty and wealth; he humbles and he exalts.” – 1 Samuel 2:7

“The LORD sends poverty and wealth; he humbles and he exalts.” – 1 Samuel 2:7

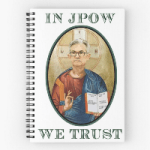

Holy Roll

A humorous graphic portraying Federal Reserve Chairman Jerome Powell, labeled “IN JPOW WE TRUST,” has captured attention.

This illustration features Powell dressed in a preacher’s robe, striking a peculiar hand gesture while grimacing as if facing discomfort. His left hand holds an outwardly positioned Bible, whose texts are mostly illegible but hint at predictions like “STOCKS ONLY GO UP,” “RECESSION CANCELLED,” and “MONEY PRINTER GOES BRRRRRRRR.”

Notably, the designer incorporates a playful twist on American French to convey the fates of market bears and short sellers, evoking locker room banter.

Crafted by the creator known as nobiggydiggy, the image likely originated during a time of monetary ease prior to March this year, when the federal funds rate lingered near zero for two years.

Back then, Powell preached a New Testament approach, advocating monetary policies infused with compassion and grace.

However, as inflation’s grip tightened, Powell shifted his tactics to a more austere Old Testament narrative. He began increasing the federal funds rate, adopting a no-nonsense policy that included messaging like “CRASH THE MARKET,” “BRING ON THE DEPRESSION,” and “BORROWERS MUST PAY.”

The curious juxtaposition of a central banker using religious fervor to deliver monetary updates mirrors reality; millions tuned in to hear Powell share his insights this week.

Primal Scream

Trillions were at stake as the two-day FOMC meeting wrapped up on Wednesday, with outcomes hinging on the interest rate adjustments announced by Powell.

As anticipated, the Fed raised the federal funds rate by 75 basis points, adjusting it to a range of 3.00 to 3.25 percent, with signals that it would exceed 4.25 percent by year’s end.

For context, this marks the first time the federal funds rate has exceeded 3.25 percent since January 2008—a significant 14 years ago, just six months after the iPhone was launched.

Post-FOMC statement, Wall Street reacted dramatically, with the Dow Jones Industrial Average (DJIA) swinging in an initial psychological reaction before ultimately tumbling 522 points by the close of trading.

A particularly engaging moment arose during Powell’s press conference. Senator Elizabeth Warren, known for her numerous political plans, took to Twitter:

“Chair Powell just announced another extreme interest rate hike while forecasting higher unemployment.

“I’ve been warning that Chair Powell’s Fed would throw millions of Americans out of work—and I fear he’s already on that path.”

However, the situation is far graver than Warren suggests. She is aware that years of unchecked government spending are nearing a tipping point, and she seems poised to blame Powell and the Fed when the inevitable collapse occurs later this year.

Inflation Deflation

To clarify, the economy and financial markets are facing the severe fallout from rising consumer prices coupled with plummeting asset values—conditions that have emerged under the stewardship of central planners like Warren and Powell.

Official figures indicate that consumer prices, as reported by the Consumer Price Index (CPI), are escalating at an annualized rate of 8.3 percent. However, the real rate of inflation is likely twice that figure.

In contrast, stock prices are on the decline, with the DJIA down over 17 percent year-to-date, and the NASDAQ plummeting more than 30 percent.

Bonds are similarly suffering; the iShares 7-10 Year Treasury Bond ETF (IEF) has dropped 15 percent since the start of the year. The yield on the 10-Year Treasury note has climbed to 3.71 percent—the highest it’s been in over a decade.

As interest rates rise in an attempt to rein in unchecked consumer price inflation, borrowing costs are skyrocketing. The interest rate on a 30-year mortgage has surged to 6.29 percent, up from just 2.88 percent last year—effectively more than doubling home acquisition costs.

With mortgage rates climbing, housing prices are now on the decline. Homes that would have easily sold six months ago now sit unsold for weeks or even months. Multiple rounds of price reductions are proving insufficient to attract buyers, indicating that further adjustments will be necessary to clear inventory.

This stark contrast of deflating asset values against inflating consumer prices is a dramatic shift from the trends observed over the past four decades. Previously, we enjoyed a period of stable consumer prices for imported goods alongside booming stock, bond, and real estate markets, with homeowners refinancing at continually decreasing rates.

In truth, inflation has lingered beneath the surface. Services that cannot be imported, such as medical care and college tuition, have inflated dramatically. The CPI has downplayed these rising costs thanks to the influx of inexpensive imported goods.

Facing Down a Wrath of Biblical Proportions

The reckless monetary expansion designed to alleviate the impacts of government-imposed lockdowns has proven overwhelming. Between February 2020 and April 2022, the Fed’s balance sheet skyrocketed from $4.15 trillion to $8.96 trillion, which clearly explains the current inflation crisis.

Now, as the Fed tightens its grip, financial markets are struggling to adapt.

Besides interest rate hikes, the Fed has slightly reduced its balance sheet to $8.32 trillion, yet there remains a significant distance to achieve a normalized balance sheet—whatever that might be.

Meanwhile, the persistent inflation poses a considerable challenge. David Haggith, editor-in-chief of The Great Recession Blog, recently noted:

“Those of us who experienced the inflation battles of the seventies know it’s quite a task to rein it in! It’s reminiscent of whack-a-mole. Hence, no one should be surprised that inflation has stubbornly remained elevated, despite the Fed’s aggressive interest rate hikes and quantitative tightening efforts. In those days, it required several years of extreme rates to fully control inflation. Today, we face a different economy that could unravel if we approach rates even half as high; yet, that might be the unintentional goal of the Fed.”

What are the implications?

The U.S. economy has already entered a recession, and yet consumer price inflation shows no signs of abating. Even if the CPI were to be halved, it would still exceed the Fed’s target rate.

Thus, the Fed will continue to raise rates in a desperate effort to atone for its past mistakes, risking further economic collapse.

As this unfolds, Warren and other populist politicians will continue to deflect blame for the turmoil they have contributed to.

The ultimate depth and duration of this crisis remain uncertain, but it’s clear we are facing more than a typical downturn…

What lies ahead is a calamity of biblical proportions.

[Editor’s note: Years of extensive currency printing have left American investors vulnerable. Learn how to safeguard your wealth and financial privacy by utilizing the Financial First Aid Kit.]

Sincerely,

MN Gordon

for Economic Prism

Return from Facing Down a Wrath of Biblical Proportions to Economic Prism