Yves here. The latest inflation report from the U.S. has drawn sharp skepticism from mainstream financial media, as illustrated by the following headlines. First, let’s take a look at a piece from the Wall Street Journal:

Wolf Richter dives into the questionable statistical adjustments made by the Bureau of Labor Statistics (BLS), which began even before this report was published.

It’s important to note that such manipulative practices not only distort the data but also result in artificially low inflation adjustments, leading to an exaggerated portrayal of GDP growth. This type of statistical tampering usually surfaces in pre-crisis conditions, as officials manipulate the narrative to maintain a façade of stability. Prior to the financial crisis, commentators like Michael Shedlock and Barry Ritholtz highlighted issues like the “birth/death adjustment” in job creation data, a method that aimed to plug the gaps from business dynamics that often went unaccounted for. Back in 2007, we included misleading official statistics in a list of indicators reflective of a ‘banana republic.’ Readers can certainly add to this list:

– Private security for the extremely wealthy

– Limited economic and class mobility

– Militarization and exaggerated external threats

– A significant concentration of wealth and assets among the elite

– Government policies favoring the extremely rich, essentially plundering public finances

– Minimal or no press freedoms

– Electoral fraud, or in extreme cases, coups and one-party rule

– Attacks on judicial independence and kangaroo courts

This numerical manipulation may appear minor on its own, but it’s yet another sign of the ongoing decline in the U.S.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

The BLS disclosed in its November Consumer Price Index (CPI) report that numerous data points for October were unavailable, and that they had to estimate some of the missing figures for November. This included approximating critical data points like Owners Equivalent Rent (OER), which constitutes 26% of the overall CPI, 33% of core CPI, and 44% of services CPI.

OER experienced a notable drop in September, an anomaly that persisted into October and November. The BLS even noted some of these discrepancies in separate communications, indicating that they were not entirely concealed.

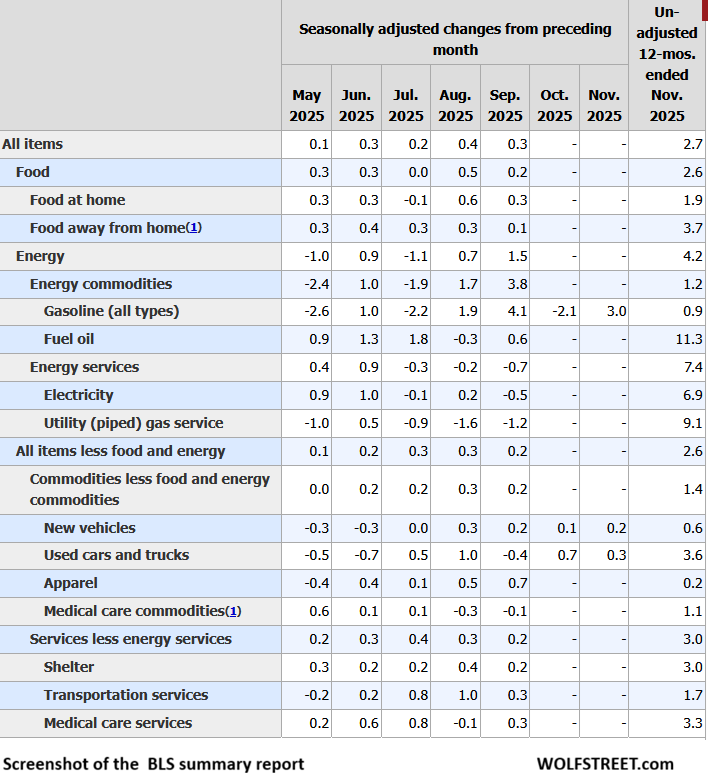

This screenshot of the CPI summary table shows that almost all the month-to-month change entries for October and November are absent, with the sole exceptions being figures derived from “nonsurvey data,” such as gasoline and vehicle prices (the BLS purchases vehicle data from J.D. Power).

BLS’s Comments on Missing Data and Its Approach

In their summary report, the BLS stated: BLS did not collect survey data for October 2025 due to a lapse in appropriations. Because of this, BLS was unable to gather this data retroactively. For some indexes, the BLS utilizes nonsurvey data sources for index calculations. BLS managed to acquire most of the nonsurvey data for October retroactively. CPI data collection resumed on November 14, 2025.

In a separate note, the BLS elaborated on some of the limitations of this CPI release here.

“What was the impact on November data collection? Collection began on Friday, November 14. By allowing additional collection hours, BLS endeavored to gather data for the entire month of November.”

They stated “attempted to collect.”

A particularly problematic statement read: “How were November indexes calculated? They were computed by comparing November 2025 prices to October 2025 prices.” However, the data for October was non-existent. “BLS could not collect October 2025 reference period survey data, so survey data was forwarded from September 2025 in line with standard procedures.”

In essence, it seems the BLS fabricated the October data.

Furthermore, the September data, which provided the basis for the fictitious October figures, was flawed due to that significant outlier drop in OER. And this flawed September data was carried over to both October and November.

Regarding OER: “BLS computes rent and owners’ equivalent rent using a six-month panel collection method [surveys are sent to the same addresses every six months].”

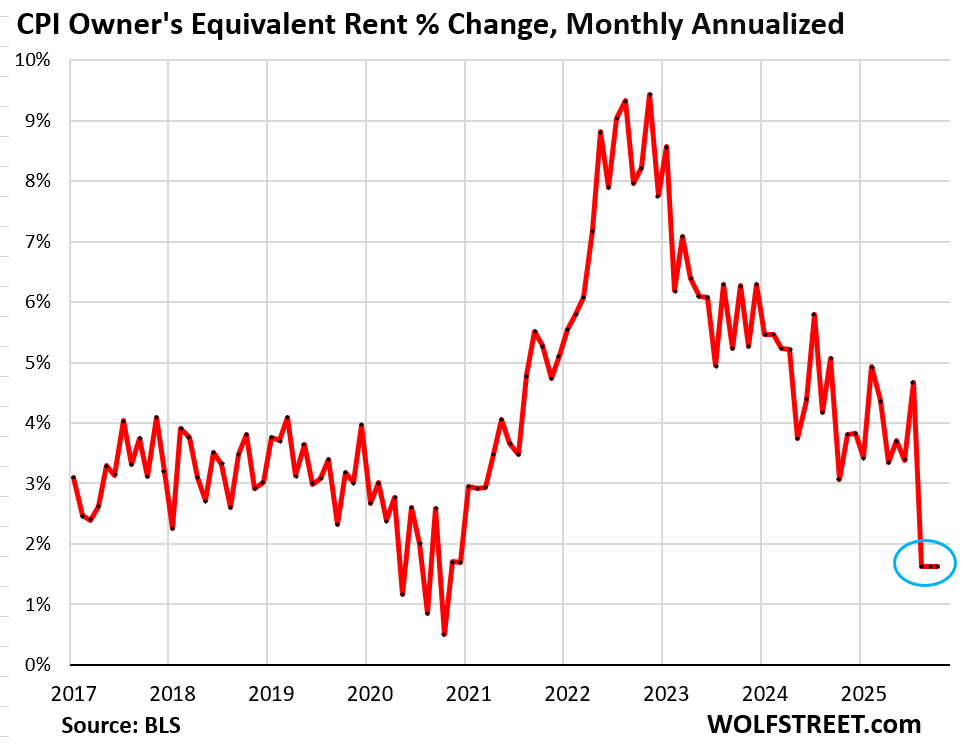

A suspicious drop in September wasn’t corrected, but rather continued into October and November, resulting in a rather peculiar chart below.

Using the BLS index data for OER as provided today…

Aug: 430.69

Sep: 431.27

Oct:

Nov: 432.44

This reveals how clearly manipulated OER looks in terms of month-to-month percentage change, annualized. It has maintained a rate of 1.6% over the past three months, a stark drop from the average of 4.1% recorded in the six months prior to the doctored September numbers. This represents a sudden shift of 2.4 percentage points, persisting for three consecutive months.

This manipulated figure constitutes 26% of the overall CPI, 33% of core CPI, and 44% of core services CPI, transforming the entire CPI into a farcical scenario

But It’s Not Just a Joke; It’s Far More Serious

Numerous processes depend on CPI data, including how “inflation protection” is calculated for Treasury Inflation-Protected Securities (TIPS), the I-series savings bonds marketed to individual investors, as well as Social Security Cost-of-Living Adjustments (COLAs) and various other inflation-related adjustments. Consequently, many beneficiaries will receive less than they should due to flawed inflation calculations.

This data also influences wider economic indicators adjusted for inflation, such as “real” consumer spending and “real” GDP, since the Bureau of Economic Analysis (BEA), which produces these economic indices, incorporates some of the CPI data, including OER, into its calculations for indices like the personal consumption expenditures (PCE) price index and the GDP deflator.

Overall, the BLS’s actions are fraught with serious implications, resulting in shortchanged investors and beneficiaries when it comes to inflation protection, while also inflating adjusted economic statistics, which admittedly aligns with the administration’s narrative.