Imagine facing a staggering 44.47 percent hike in your monthly water bill by 2027. How would that make you feel?

Imagine facing a staggering 44.47 percent hike in your monthly water bill by 2027. How would that make you feel?

Consumer prices have already surged by 21.5 percent over the past four years, according to government statistics. So, would an additional 44.47 percent jump in your water bill by 2027 be something you’d accept gladly?

This is the proposed rate increase from California’s Golden State Water Company for residents in the Santa Maria Service District. Should this be approved, as indicated in the public participation hearing notification sent to customers, the typical residential user could see their monthly bill rise from $67.94 in 2024 to $101.81 by 2027, not including additional surcharges.

Other service areas serviced by Golden State Water Company are also grappling with similar rate hikes. These increases are being requested to support the company’s General Rate Case (GRC) filed last year with the California Public Utilities Commission. The GRC outlines plans for local infrastructure investments and water rates for 2025, 2026, and 2027.

Residents across California, like those in numerous states, are facing continuous utility bill increases. A recent proposal for electricity rates even suggested a program that would charge customers based on their income, rather than consumption. Under this plan, individuals with higher earnings would pay more for electricity regardless of their usage.

This income-based rate structure was eventually replaced by a new two-part billing structure. The first part includes the customer’s usage rate, while the second is a flat fee of $24.15 for most consumers, with certain relief options for low-income users.

Do You Prefer a Recession?

Both the latest PCE price index and CPI report indicate that—the situation may be improving slightly, but prices are still rising at a rate far exceeding the Federal Reserve’s desired 2 percent target. Combined with skyrocketing utility bills, American households are feeling tremendous pressure.

One possible solution to combat inflation is a recession. This economic downturn, characterized by job losses and forced frugality, could reduce demand for goods and services, potentially slowing the inflationary trend. It might even lead to deflation.

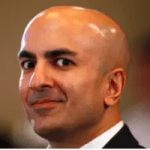

Interestingly, this somewhat grim solution was recently suggested by Neel Kashkari, the President of the Minneapolis Federal Reserve and a key figure in the TARP bailout. During an appearance on the Financial Times podcast, The Economics Show, he noted:

“Americans’ ‘visceral’ hatred of inflation means that some people might prefer a recession to a spike in prices.”

“The economy in the U.S. remains relatively strong, the labor market is robust, inflation is decreasing, and yet many people are deeply dissatisfied with the economic conditions due to the high inflation they’ve encountered.”

Kashkari’s comments supported his view for maintaining the federal funds rate at its current high range of 5.25 to 5.5 percent. He believes more data is needed to assure the Fed that inflation is truly abating. To him, it’s preferable to keep rates elevated for an extended period and risk lower growth than allow consumer price inflation to spiral out of control again.

Are You Prepared for Stagflation?

Perhaps Kashkari is positioning himself to succeed Fed Chair Jerome Powell when his term concludes in 2026. His unconventional ideas and vision for credit market intervention may make him a candidate for that role. Who can say?

However, it seems that Kashkari might be overestimating the Federal Reserve’s control over economic outcomes. Increasing interest rates typically raise borrowing costs, slowing economic growth as both businesses and individuals may be less inclined to borrow or spend.

Kashkari believes this could trigger a recession while curbing consumer price inflation. Yet, the situation may not be as straightforward as central planners envision.

For instance, what if the economy continues to slow yet prices persist in rising? What if we find ourselves facing stagflation, a troubling blend of stagnant growth and inflation reminiscent of the late 1970s?

Holding interest rates at relatively high levels can only achieve so much. While rates are significantly higher than in previous years, they are still slightly below their long-term average mean, suggesting that the Fed may need to consider further hikes rather than cuts.

Another crucial driver of consumer price inflation is deficit spending. Even with the recent $482 billion boost from income tax revenue, the Treasury is projecting a nearly $2 trillion deficit in fiscal year 2024. Such extensive deficits are inherently inflationary and threaten the long-term financial stability of the U.S. government and the dollar.

Should the Fed cut interest rates now, it could further elevate consumer prices. Conversely, maintaining current rates amid $2 trillion deficits may not effectively curb inflation.

This Recession Won’t Stop It

Essentially, monetary policy is tightening while fiscal policy continues to expand, risking the emergence of an inflationary recession—stagflation—in the U.S. economy. This scenario may already be unfolding.

Recent reports from purchasing managers in Chicago indicate a significant contraction in the economy. The Chicago PMI for May dropped to a concerning 35.4, signaling contraction in manufacturing activity.

This marks the sixth consecutive reading in contraction territory, the lowest figure since May 2020 during the COVID-19 lockdowns. For a reading this low, one must look back to the financial crisis of late 2008.

Diving deeper into the report, nearly all components are declining—new orders, employment, inventories, supply deliveries, production, and order backlogs—pointing to contraction.

Interestingly, there is one aspect that is rising: prices paid. This indicates that while manufacturing is shrinking, costs are increasing, evoking the essence of stagflation. Furthermore, this suggests that, against Kashkari’s assumptions, a recession alone cannot be relied upon to slow consumer price inflation.

Until Washington takes serious action to balance the budget, consumer price inflation is unlikely to abate—recession or not. With the current level of deficit spending, the distinction is largely irrelevant.

The earliest Washington might address deficit reduction is well after the election, by which time the repercussions of stagflation will likely be significant.

Losing your job is already an arduous experience; having your water bill climb by 44.47 percent on top of that is an additional blow.

Good luck! You’ll certainly need it.

[Editor’s note: Struggling with your electricity bill? Don’t worry, I’ve got you covered. I recently created a unique publication titled: “Energy Independence: Backyard Energy Savings and Abundant Power In A World Without Reliable Electricity.” >> Click Here for your complimentary copy.]

Sincerely,

MN Gordon

for Economic Prism