In today’s global economy, the status of the US dollar carries significant weight. As we delve into the trends of dollar reserves, it’s essential to understand how its position has transformed over the years and what this means for the United States. Following the dissolution of the USSR in 1994, the dollar enjoyed a period of unrivaled dominance. However, as the US’s share of global GDP diminishes, the dollar’s preeminence as the reserve currency is projected to decline.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

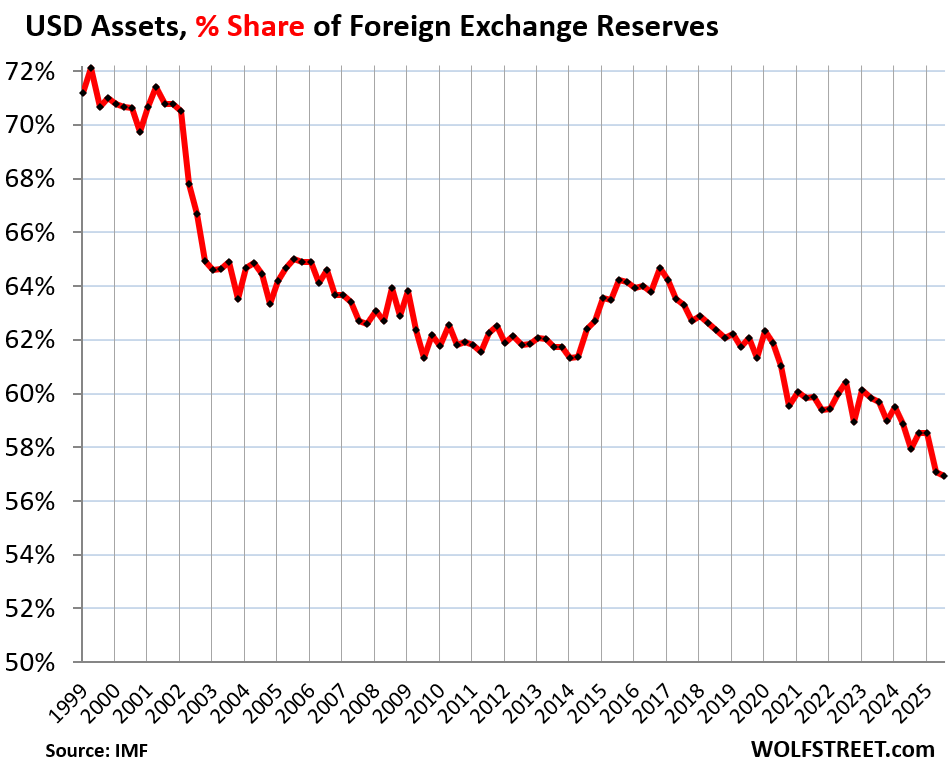

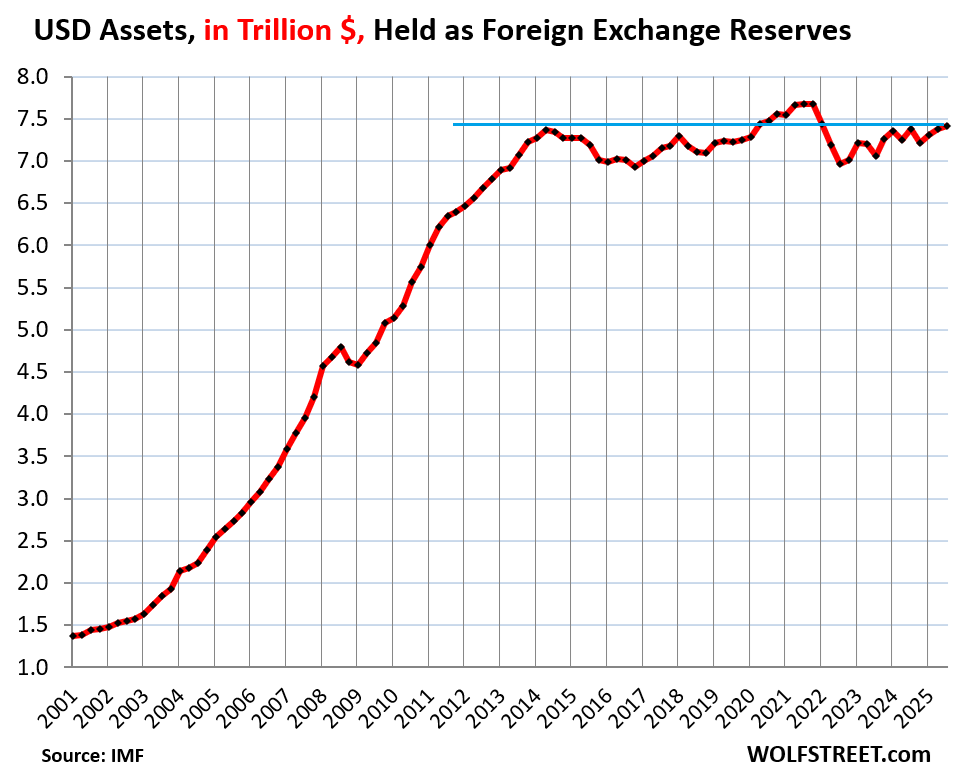

According to recent data from the IMF regarding the Currency Composition of Official Foreign Exchange Reserves, the share of USD-denominated assets held by foreign central banks decreased to 56.9% in Q3, down from 57.1% in Q2 and 58.5% in Q1. This marks the lowest percentage since 1994.

USD-denominated foreign exchange reserves encompass a variety of assets including US Treasury securities, mortgage-backed securities (MBS), agency securities, and corporate bonds. However, assets denominated in the bank’s own currency—such as the Fed’s Treasury securities or the European Central Bank’s euro-denominated assets—are not included in this tally.

Interestingly, foreign central banks have not offloaded their US-dollar-denominated assets like Treasury securities. Instead, they have slightly increased their holdings. However, these banks have also significantly turned to other currencies—especially smaller ones—resulting in a declining percentage share of USD assets over the years. This stagnation has occurred despite the dollar’s status as the most substantial reserve currency, with all other currencies combined still falling short of its influence.

Why Is Holding the Top Reserve Currency Vital for the US?

The acquisition of USD-denominated assets by foreign central banks is essential as it drives up the prices and lowers the yields of these assets. The dollar’s status as the leading reserve currency has allowed the US to borrow at lower costs, thereby facilitating the funding of its immense trade and budget deficits over decades. If this trend continues, the decreasing demand for USD-denominated debt could eventually jeopardize the sustainability of these deficits.

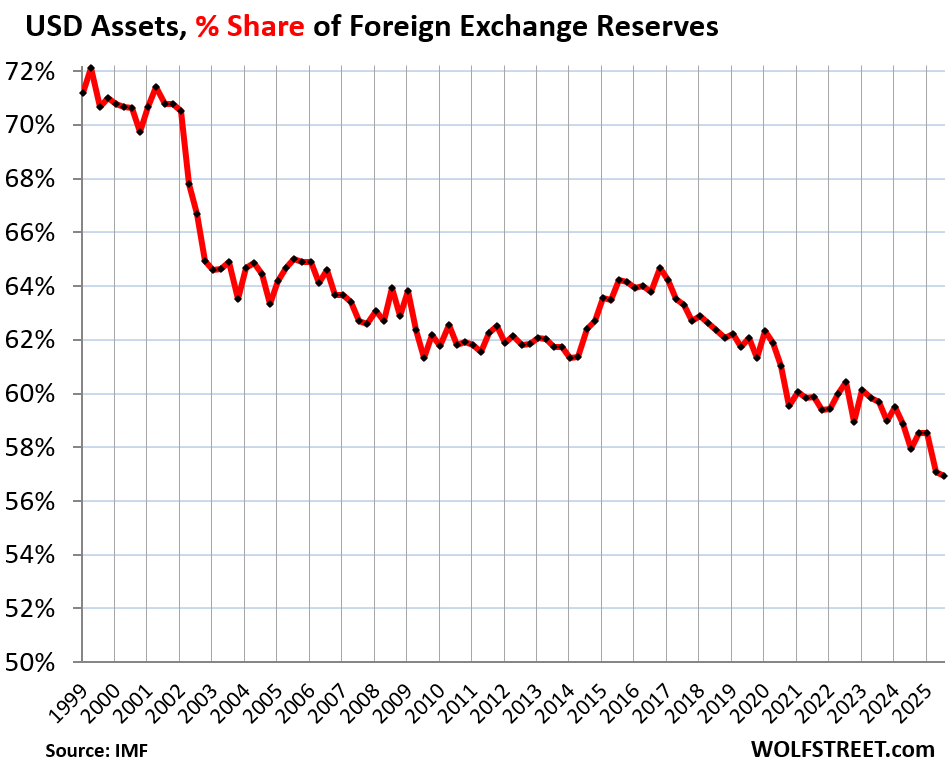

The dollar’s share previously dipped below 50% in the early ’90s, after a prolonged decline from its peak of 85.5% in 1977. This decline paralleled a severe economic crisis in the US characterized by soaring inflation, high-interest rates, and multiple recessions, which eroded central banks’ confidence in the Federal Reserve’s ability to manage inflation effectively.

The dotted line in the chart below marks the 50% threshold. The dollar’s share plummeted to 46% in 1991, but as inflation was brought under control, central banks began investing heavily in dollar assets again.

The rise of the euro posed another threat to the dollar, though it did not reach the parity with the dollar that European leaders had envisioned. The euro’s ascent was halted by the Euro Debt Crisis starting in 2009.

In the last decade, numerous smaller “non-traditional reserve currencies,” as categorized by the IMF, have emerged, further complicating the dollar’s dominance.

Recent Changes in USD-Denominated Securities

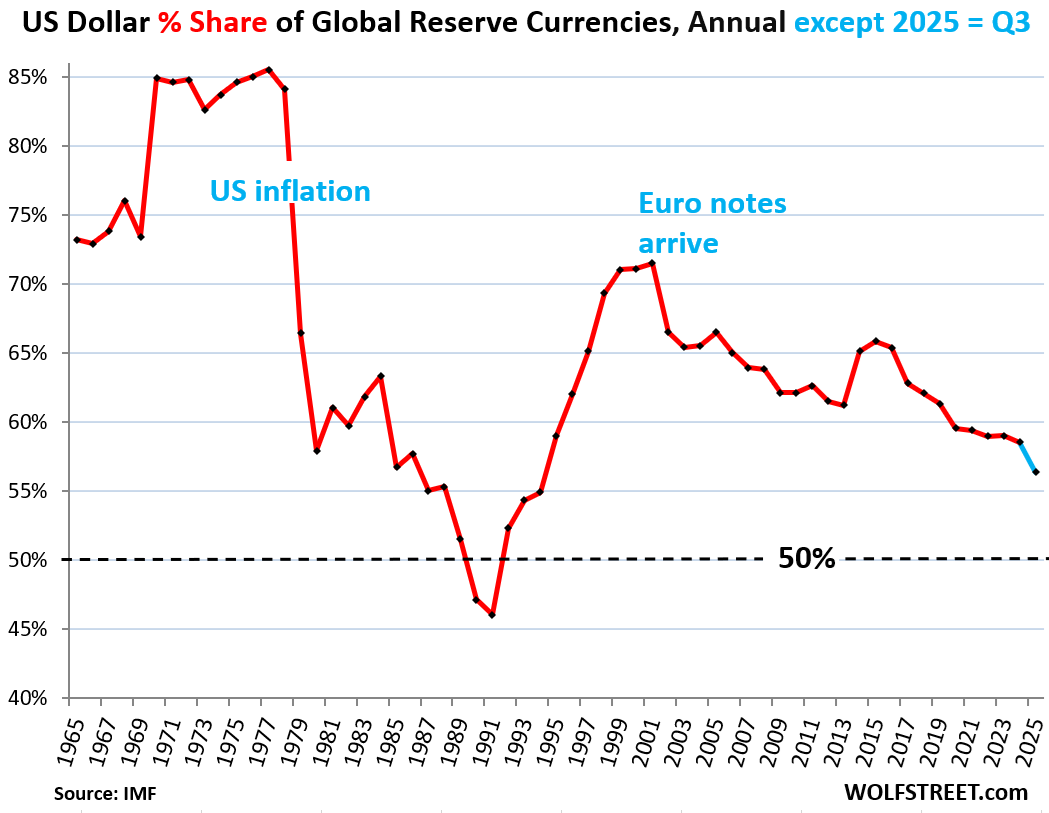

While foreign central banks saw a minor increase in their USD-denominated asset holdings to $7.4 trillion in Q3—marking the third consecutive increase—these holdings have essentially remained flat since mid-2014 despite fluctuations.

The decline in the percentage share of USD assets is attributed to the rise of reserves in other currencies, particularly from smaller nations, as central banks diversify their portfolios away from traditional USD assets.

Analysis of Foreign Exchange Reserves by Currency

As of Q3, central banks’ total holdings of foreign exchange reserves reached $13.0 trillion, measured in USD. Here are the top holdings:

- USD assets: $7.41 trillion

- Euro assets (EUR): $2.65 trillion

- Yen assets (YEN): $0.76 trillion

- British pound assets (GBP): $0.58 trillion

- Canadian dollar assets (CAD): $0.35 trillion

- Australian dollar assets (AUD): $0.27 trillion

- Chinese renminbi (RMB) assets: $0.25 trillion

The euro has maintained about a 20% share since 2015, though it had previously surged towards 25% before the Euro Debt Crisis.

The balance of reserve currencies showcased in the chart continues to evolve, reflecting a gradual shift away from the dollar, while the euro’s share has remained relatively stable during recent years.

The Emergence of Non-Traditional Reserve Currencies

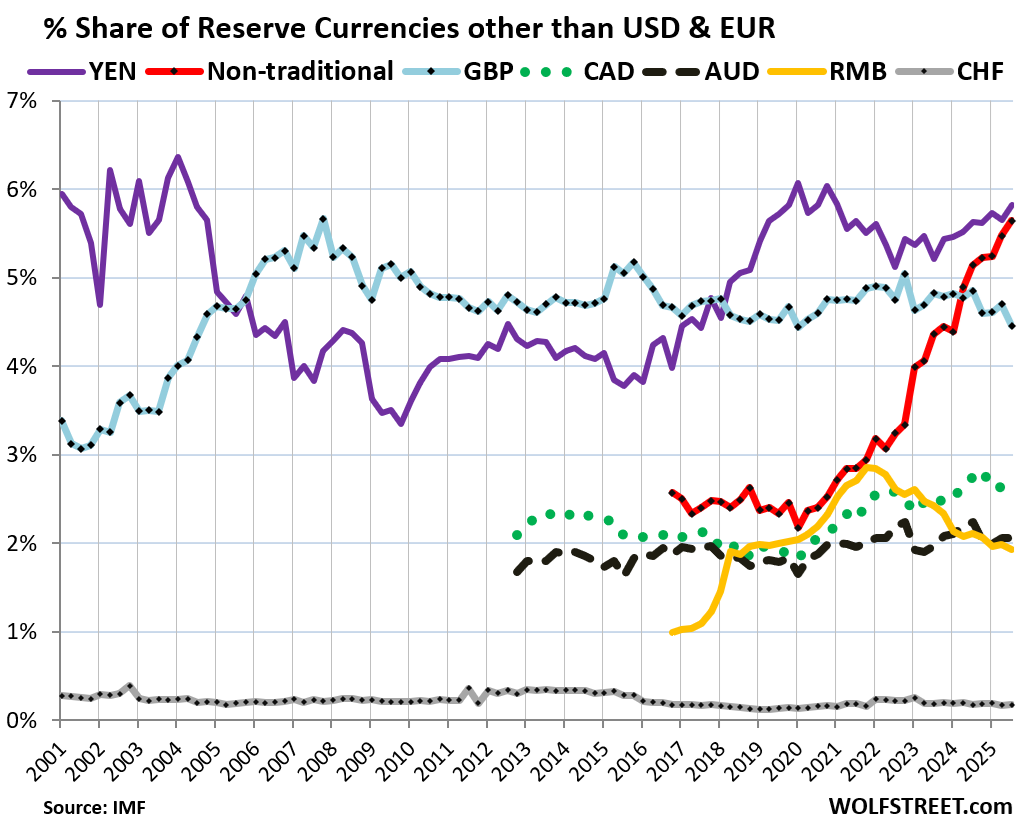

The chart below highlights the notable rise of various smaller “non-traditional reserve currencies.” These currencies have seen an increase in share, reaching a collective 5.6%, placing them just below yen-denominated assets (5.8%).

However, the share of the renminbi (RMB) has declined since Q1 2022, reverting to its 2019 levels due to ongoing capital controls and convertibility challenges.

Overall, both the USD and RMB have ceded ground to these non-traditional reserve currencies as central banks diversify away from both USD and RMB denominations.

In case you missed my update on a slightly less bleak situation: US Government Interest Payments to Tax Receipts, Average Interest Rate on the Debt, and Debt-to-GDP Ratio in Q3 2025