The Future of Fitness: Cool Gadgets and Practical Tips for 2026

In our fast-paced world, maintaining fitness can be a challenge. With an overwhelming array of supplements, technologies, and wellness solutions, making informed decisions becomes crucial. As we hurtle into 2026, new advancements in wearable tech and home fitness that enhance our well-being have emerged. Let’s explore the latest innovations and some practical tips to optimize your health and fitness journey.

1. Oura Ring

Start your fitness tracking journey with the Oura Ring, a sleek and discreet wearable that monitors essential metrics such as heart rate, sleep quality, and stress levels. Its design as a smart ring allows users to access data without the bulkiness of a smartwatch. For optimal functionality, a subscription is required, but its insights can be particularly beneficial for individuals with health conditions that require close monitoring.

- Price: $599 – $850 AUD (depending on finish) + approx. $9.50 AUD/month subscription

- Best for: Anyone seeking elite sleep and recovery metrics without a bulky device on their wrist.

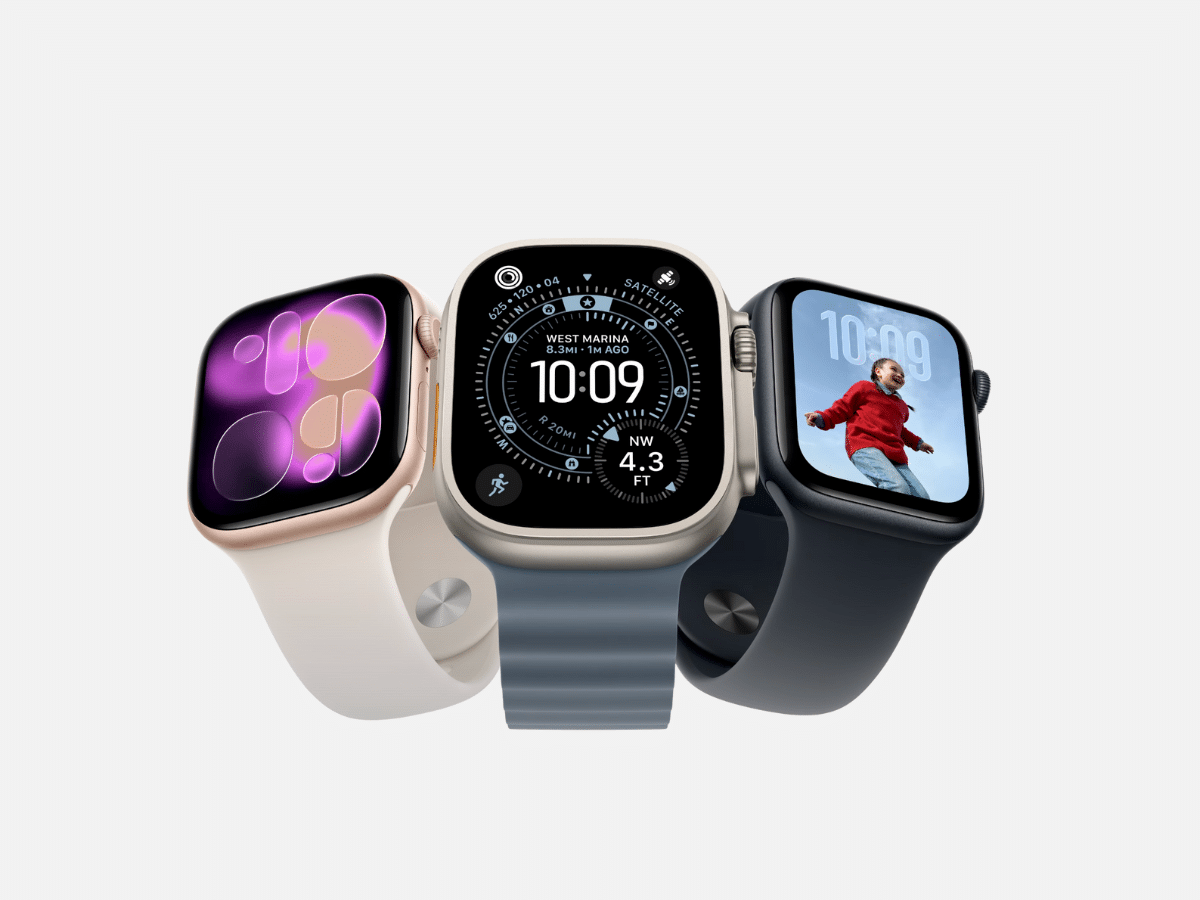

2. Apple Watch

With its 11th generation, the Apple Watch has solidified its place as a favorite among fitness enthusiasts. It provides accurate biometrics and alerts users to various health concerns, including elevated blood pressure. This device seamlessly integrates fitness tracking with daily communications, making it a versatile companion.

- Price: Starts at $399 USD / $679 AUD (Aluminum) to $749+ USD (Titanium)

- Best for: Individuals looking for a smart gadget with fitness insights and health alerts.

3. Throne One

For those focused on gut health, the Throne One offers a unique approach. This advanced sensor attaches to your toilet, tracking bathroom habits and providing personalized feedback on gut health. The device is particularly useful for individuals monitoring their digestion and hydration.

- Price: Approx. $520 AUD + $9 AUD/month membership

- Best for: Anyone passionate about understanding gut health without excessive manual tracking.

4. Prenuvo Full-Body MRI Scans

Aimed at preventative health care, Prenuvo offers full-body MRI scans to detect potential health issues early. This revolutionary approach can provide peace of mind for those concerned about family health history.

- Price: Approx. $3,800 – $6,000 AUD

- Best for: High-risk individuals seeking proactive health measures.

5. Rythm At-Home Blood Panels

Skip the clinic visit with Rythm’s at-home blood panels. For a monthly fee, you can easily test vital biological markers from the comfort of home and receive a complete health overview.

- Price: Approx. $120 AUD per kit/month

- Best for: Individuals wanting to monitor health metrics without getting a referral or visiting a clinic.

6. Tonal 2

The Tonal 2 aims to revolutionize home workouts by incorporating a scalable digital weight system within a sleek touchscreen interface. This compact device offers tailored workouts while providing real-time feedback on form and technique.

- Price: Approx. $6,500 AUD + approx. $90 AUD/month subscription

- Best for: Fitness enthusiasts wanting personal training guidance at home.

7. Ascentiz H1 Pro Exoskeleton

Imagine an exoskeleton that assists your physical movements. The Ascentiz H1 Pro enhances mobility during activities like hiking or running, making challenging terrains feel more manageable.

- Price: Starts at approx. $1,700 AUD

- Best for: Those with mobility concerns or individuals carrying heavy loads.

8. Sun Stream Evolve Mini Infrared Sauna

Home saunas are becoming more accessible with the Evolve Mini Infrared Sauna, which utilizes infrared light for a unique sauna experience. This device offers recovery benefits without needing extensive space.

- Price: Approx. $3,995 AUD / $2,600 USD

- Best for: Individuals considering at-home recovery and detox.

Conclusion

In 2026, the fitness landscape is richer and more innovative than ever. The gadgets mentioned above are not only designed to monitor health metrics but also to provide actionable insights that can guide your fitness journey. Remember, while technology can enhance your health and wellness, it’s crucial to balance it with practical habits such as regular exercise, proper nutrition, and maintaining social connections. Embrace these tools but remember that the foundation of wellness lies in a balanced lifestyle.