This week marks the Naked Capitalism fundraising drive, and we’re thrilled to announce that 1,350 supporters have already contributed to our mission of fighting corruption and predatory practices, especially within the financial sector. We invite you to support our cause by visiting our donation page, where you’ll find options for giving, including check, credit card, PayPal, Clover, or Wise. To learn more about the reasons behind this fundraiser, what achievements we’ve made in the past year, and our ambitious goals, check out our latest updates regarding original reporting.

Yves here. As many are aware or will soon find out, the announcement for the 2025 Nobel Peace Prize winner is set for Friday. Trump’s cringeworthy personal lobbying for this award should, in itself, serve as grounds for disqualification. The article below outlines specific reasons the Nobel committee ought to reject Trump’s claims. Unfortunately, it overlooks the fact that his assertions regarding the achievement of notable peace settlements are either false or significantly exaggerated. For instance, he had no role in de-escalating tensions between Pakistan and India during their recent conflicts; Modi reportedly was furious at Trump for attempting to take credit for the resolution. Likewise, for anyone following the news in Southeast Asia, peace between Thailand and Cambodia remains elusive, with ongoing skirmishes and unresolved disputes, and U.S. involvement is nonexistent.

Moreover, it’s disheartening to discuss Trump’s complicity in the ongoing humanitarian crisis in Gaza through his unqualified support for Israel. The fact that Netanyahu nominated Trump for the Peace Prize speaks volumes about the latter’s qualifications—or lack thereof.

If Trump were to win, it would not signify any achievement in peace but rather reflect the power dynamics at play, especially with EU members urging the committee to award him the prize to improve relations given his ties to Putin. As many, including various commentators, have pointed out, a Trump win would signal the complete devaluation of the Nobel Peace Prize, a trend that began with Obama’s selection.

My preference goes to the members of the Sumud flotilla.

Stay tuned for updates after the announcement.

Update: 8:30 AM EDT. Media reactions:

Trump loses Nobel Peace Prize he shamelessly campaigned for https://t.co/b4kJB9qb1n

— TIME (@TIME) October 10, 2025

And critical insights:

Why award the Nobel Peace Prize to an opposition leader who supports U.S. military pressure against her own country? Does democracy really deliver peace, and is U.S. military intervention the path to democracy?

pic.twitter.com/6q1cUHtxFT— Glenn Diesen (@Glenn_Diesen) October 10, 2025

What has Maria Corina Machado done to deserve the Nobel Peace Prize? She has accepted U.S. taxpayer funding for anti-government NGOs and supported military intervention in Venezuela. Does the Nobel Committee still hold legitimacy?

https://t.co/uOWxwnQtR2— Anya Parampil (@anyaparampil) October 10, 2025

Venezuela’s election loser, Maria Corina Machado, wins the Nobel Peace Prize: ‘If we win, we will move the Venezuelan embassy to Jerusalem to support Israel.’ Her policies reflect those of many U.S.-supported Latin American politicians.

pic.twitter.com/0UXBVIhIhe— Afshin Rattansi (@afshinrattansi) October 10, 2025

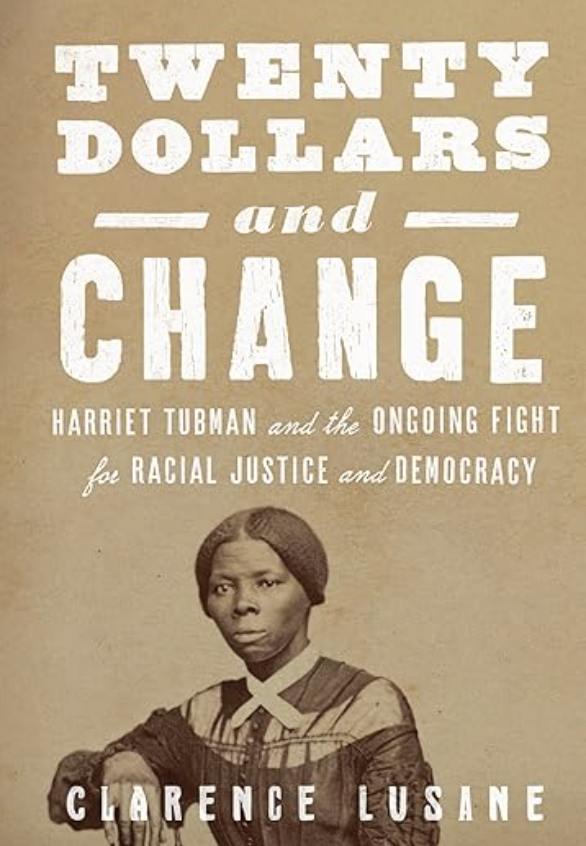

By Clarence Lusane. Originally published at TomDispatch

Many are aware that President Donald Trump is fervently seeking a Nobel Peace Prize, having remarked, “They will never give me a Nobel Peace Prize. It’s too bad. I deserve it, but they will never give it to me.”

For once, he’s partially correct; he won’t receive one. However, he certainly does not deserve it. There are countless reasons why he falls short, but for simplicity, let me provide ten.

As a political scientist concentrating on human rights, racial justice, and social movements, I’ve extensively studied the Nobel Peace Prize. Previously at American University’s School of International Service, I even taught a course on its history and politics. Last year, I spent time at the Nobel Peace Center museum and the Norwegian Nobel Institute, delving into original documents, including nomination letters.

Interestingly, I find myself within one of the eligible categories for making nominations, which include members of “parliamentary assemblies,” past laureates like Malala Yousafzai and Al Gore, and various academics and peace institute directors.

Though the Committee has never explicitly confirmed it, I’m going to assume I can also make an “un-nomination.” Believe it or not, amidst numerous letters supporting Dr. King’s nomination, there were also requests to deny him the prize, even if most originated from individuals without the eligibility to nominate.

To put it plainly: There’s no one more unworthy of a Nobel Peace Prize than President Trump. His authoritarian and antidemocratic actions pose increasing risks—not only for the United States but for the international community as well. Despite this, he has been nominated by various Republican allies, eager to court favor, and global leaders like Gabon’s President Brice Oligui Nguema, who seized power through a military coup, and Azerbaijan’s Ilham Aliyev, who has ruled for decades. These figures recognize that such nominations feed Trump’s ego and divert criticism from their own misdeeds.

Importantly, the Nobel Committee does not disclose which individuals or groups were nominated in any given year until 50 years later. Therefore, the only way Trump would know he was nominated by figures like Israeli Prime Minister Benjamin Netanyahu or Cambodia’s Prime Minister Hun Manet would be if they made it public or directly informed him.

Autocracy, Racism, and Lawlessness Are Not Qualifications

The award typically considers a nominee’s actions over the preceding year. Thus, Trump’s “peace” efforts from his first term and time out of office are irrelevant to next year’s considerations. Let’s reflect on his initial eight months in office for 2025 and ask: What has he done to not merit the award?

First, within hours of returning to office, the “peace” president pardoned and commuted the sentences of 1,500 insurrectionists who rioted on his behalf on January 6, 2021. Those individuals violently assaulted police officers in an effort to disrupt the peaceful transfer of power to the legitimately elected Joe Biden. Instead of condemning their actions, Trump rewarded lawlessness.

Second, in his reprehensible campaign against undocumented immigrants, who he claims are “poisoning the blood of the country,” his administration unlawfully kidnapped individuals from American streets and unlawfully transported them to appalling detention centers in El Salvador and elsewhere. Some had committed no crimes and were legally residing in the United States or were U.S. citizens.

Third, he shut down the United States Agency for International Development (USAID), a vital agency in humanitarian efforts for decades. As Oxfam highlighted, this decision risks depriving at least 23 million children of their right to education and potentially 95 million people from access to basic healthcare, leading to millions of preventable deaths annually.

Fourth, he has mobilized Immigration and Customs Enforcement (ICE) personnel, National Guard, and other military troops in cities such as Los Angeles, Washington, D.C., and Chicago, purporting to protect ICE facilities from “attacks by Antifa and other domestic terrorists.” In Los Angeles, he claimed the city was “under siege” by protesters opposing his immigration raids. Ironically, it was Trump’s own inhumane ICE directives that sparked this backlash. In Washington, he falsely claimed to deploy troops to curb rampant crime, which was merely a smokescreen for his ongoing anti-immigrant campaign targeting vulnerable populations.

Fifth, indicating his desire to initiate a new imperialistic phase, he has threatened to seize Canada, Greenland, and the Panama Canal. CNN highlighted at least nine inaccuracies in his rationale for including Canada as the 51st state, including that its citizens are in favor (they aren’t) and that it restricts U.S. banks (it doesn’t). In the case of Greenland, Trump has not ruled out using military force for what he calls “security purposes,” despite its status as a self-governing territory of Denmark with no intention of joining the U.S.

Sixth, in a blatant manipulation of power, he has pressured Brazil to halt the prosecution of his ally, former President Jair Bolsonaro, who, like Trump, was involved in an attempted power grab after losing a legitimate election. Trump labeled the legal proceedings as a “witch hunt” and threatened a 50% tariff on Brazilian goods if they continued.

Seventh, resorting to his characteristic unconstitutional executive orders, he threatened legal repercussions against two American professors involved with or advocating for the International Criminal Court (ICC). The ICC (which the U.S. is not part of) prosecutes war crimes and acts against humanity, which, notably, have no statutes of limitation. Trump’s hostility seems particularly directed at the ICC’s arrest warrant for Israeli Prime Minister Netanyahu, who is also implicated in war crimes.

Eighth, Trump’s June airstrikes on Iranian nuclear sites were executed under dubious legal authority. The ongoing debate among lawmakers and legal experts about whether he acted unlawfully highlights the carelessness surrounding his military decisions. Despite his claims of having “completely obliterated” Iran’s nuclear program, reports indicate that the damage was minimal, only setting back the program by a few months. His own Defense Intelligence Agency faced repercussions, leading to the ousting of Lieutenant General Jeffrey Kruse for reporting the truth.

Ninth, he has withdrawn the United States from crucial international organizations, including the World Health Organization and UNESCO. His withdrawal from lesser-known bodies like the Council of Europe’s European Commission against Racism and Intolerance (ECRI) is particularly personal to me, as I held the role of U.S.-appointed “independent expert” there, witnessing its invaluable work firsthand.

Tenth, he has played a role in the ongoing genocide and famine unfolding in Gaza. While he claims to have ended various conflicts, he has failed to act decisively in the one where intervention could have made a real difference. His unholy alliance with Netanyahu has led to insensitivity towards the dire situation in Gaza, compounded by his ongoing supply of weaponry to Israel.

Notably, I do not even consider Trump’s cringeworthy campaign for the Nobel Peace Prize as a reason for his unworthiness; that seems inherently obvious. It reminds me of Steven Wright’s quip: “I’d kill for a Nobel Peace Prize.” It’s hard to envision figures like Nelson Mandela or Martin Luther King Jr. groveling for the award while also engaging in unlawful military actions and advocating the renaming of the Department of Defense to the Department of War.

In fact, a Washington Post-Ipsos poll revealed that a staggering 76% of Americans believe he does not deserve the Nobel Peace Prize, including 49% of Republicans.

It baffles me that former Secretary of State Hillary Clinton would nonchalantly suggest nominating Trump, a twice-impeached and convicted felon, for the Nobel Prize if he were to broker a ceasefire in Ukraine. It’s abundantly clear that Trump shows little regard for Ukraine’s sovereignty, often expressing contempt for it while accommodating Russian President Vladimir Putin. Even a successful peace intervention should not absolve him of his broader autocratic policies.

Note to Trump: The Award Must Be Earned

Trump’s authoritarian push to reshape American governance and undermine its institutions poses a direct threat to peace. His relentless attacks on a free press, manipulation of academic institutions, and blatant disregard for judicial oversight all suggest a drive to manipulate the electoral process in his favor. While various terms can describe his governance—such as fascism, authoritarianism, and corruption—his most egregious trait may be his cruelty. His desire for power and revenge has led to immense suffering among marginalized communities.

Trump potentially ranks as one of the most unethical and vindictive presidents in U.S. history. Kindness and empathy seem foreign to him; as evident by his comments at the memorial for the slain Charlie Kirk, he said, “I hate my opponent, and I don’t want the best for them.”

The Nobel Peace Prize is awarded to “the individual who has done the most or best to advance fellowship among nations, reduce military presence, and promote peace congresses.” Trump meets none of these criteria.

Let Trump continue to portray himself as a victim, dabbling in intimidation, bribery, and cozying up to despots. History will surely document the horrors of the Trump era, widely condemned and criticized, similar to our reflections on slavery, segregation, and McCarthyism. Let’s hope the Nobel Peace Prize remains an institution that Trump cannot tarnish or devalue.

Copyright 2025 Clarence Lusane