In the wake of the abduction of Venezuelan President Nicolás Maduro and his wife, Cilia Flores, striking contrasts emerged between Trump’s characteristic bravado and the cautious assertions from his administration. Notably, Trump overlooked the narco-terrorism rationale, which was ostensibly connected to a U.S. indictment, and instead focused on the potential for U.S. companies to tap into Venezuela’s vast oil reserves. He proclaimed, “We’re going to have our very large United States oil companies, the biggest anywhere in the world, go in, spend billions of dollars, fix the badly broken oil infrastructure, and start making money for the country.”

However, many observers quickly drew parallels between this press conference and Bush’s “Mission Accomplished” declaration, particularly as the Venezuelan government retained its authority and its interim president, Delcy Rodriguez, asserted that Maduro remained the nation’s leader, refusing to bow to what they termed U.S. colonial demands. In a more tempered response, Secretary of State Marco Rubio characterized U.S. goals as more restricted, focusing solely on ousting Maduro while trying to balance Trump’s show of force with the reality that the U.S. was far from controlling Venezuela. According to Politico:

Following the U.S. capture of Venezuelan leader Nicolás Maduro, Secretary of State Marco Rubio indicated that the future of the Latin American country remains uncertain.

Democratic leaders have criticized the administration’s decisions regarding Venezuela, urging the White House to seek congressional approval for military actions.

In several interviews, Rubio stressed that the U.S. is not at war with Venezuela, yet he refrained from detailing the exact nature of U.S. involvement following Maduro’s arrest and Trump’s controversial statement about the U.S. managing Venezuela.

“We are at war against drug trafficking organizations, not at war against Venezuela,” Rubio explained on NBC’s “Meet the Press.” He also confirmed that oil sanctions would continue, with the option to strike against drug boats directed at the U.S.

While Rubio clarified on CBS’s “Face the Nation” that the U.S. is not currently occupying Venezuela, he did not dismiss the possibility that this might be reconsidered in the future.

Trump, Rubio concluded, “does not feel the need to publicly dismiss any options available to the United States, even if that’s not currently being observed.”

“What you’re witnessing now is a quarantine allowing us to exert significant influence over what occurs next,” he added.

Experts familiar with the region, including Larry Johnson, have expressed the complexities involved in overcoming Venezuela compared to Iraq, noting that the U.S. military is presently smaller and less capable. A concise articulation from Modern War Monitor elaborates:

Venezuela is heavily armed. Years of political strife, combined with an expanded role for security forces and pro-government militias, mean that weapons and combat experience are prevalent. The nation’s extensive, porous borders have been crossed by guerrilla groups, paramilitaries, and other criminal entities.

To understand potential scenarios, one can observe the armed conflict in Colombia, which has persisted since 1964, involving the state and various factions like FARC and ELN. This ongoing turmoil was exacerbated by the ability of armed groups to cross borders undetected, facilitating the movement of illicit goods. Even with significant U.S. aid under Plan Colombia and numerous efforts to end hostilities, the state never achieved absolute victory; violence simply evolved.

Translating this scenario to post-Maduro Venezuela, which could be managed by U.S.-supported figures, one might anticipate bombings of governmental establishments, high-profile assassinations, and sabotage of oil facilities. Kidnapping Americans or U.S. contractors could become a lucrative strategy, where armed groups might escape across borders into inhospitable areas when the heat is on.

Even reports from Sky News highlight the resilience of sentiments in Caracas, capturing ordinary citizens’ voices:

🗣️ “The U.S. is not interested in freedom or democracy; it seeks to control our oil.”

Venezuelans gathered to express unity with Nicolás Maduro, following U.S. airstrikes.

For more updates: https://t.co/4w875fZU8W pic.twitter.com/b5byRmj15m

— Sky News (@SkyNews) January 4, 2026

Trump’s approach to oil initiatives resonates with his historical style of presenting grand ambitions without detailed plans. He has boasted about a “raw earths” deal with Ukraine’s Zelensky, which proved challenging despite the U.S. holding substantial leverage through intelligence and military support. Compounding concerns, more than half of Ukraine’s resources were in Russian control at the time of the agreement, leaving uncertain prospects for outcomes. Additionally, in the 28-point plan circulated, negotiators Steve Witkoff and Jared Kushner emphasized that one of the foremost demands involves joint ownership of the Zaporzhizhia nuclear facility, a notion dismissed as unrealistic by many, given Russia’s claim over it.

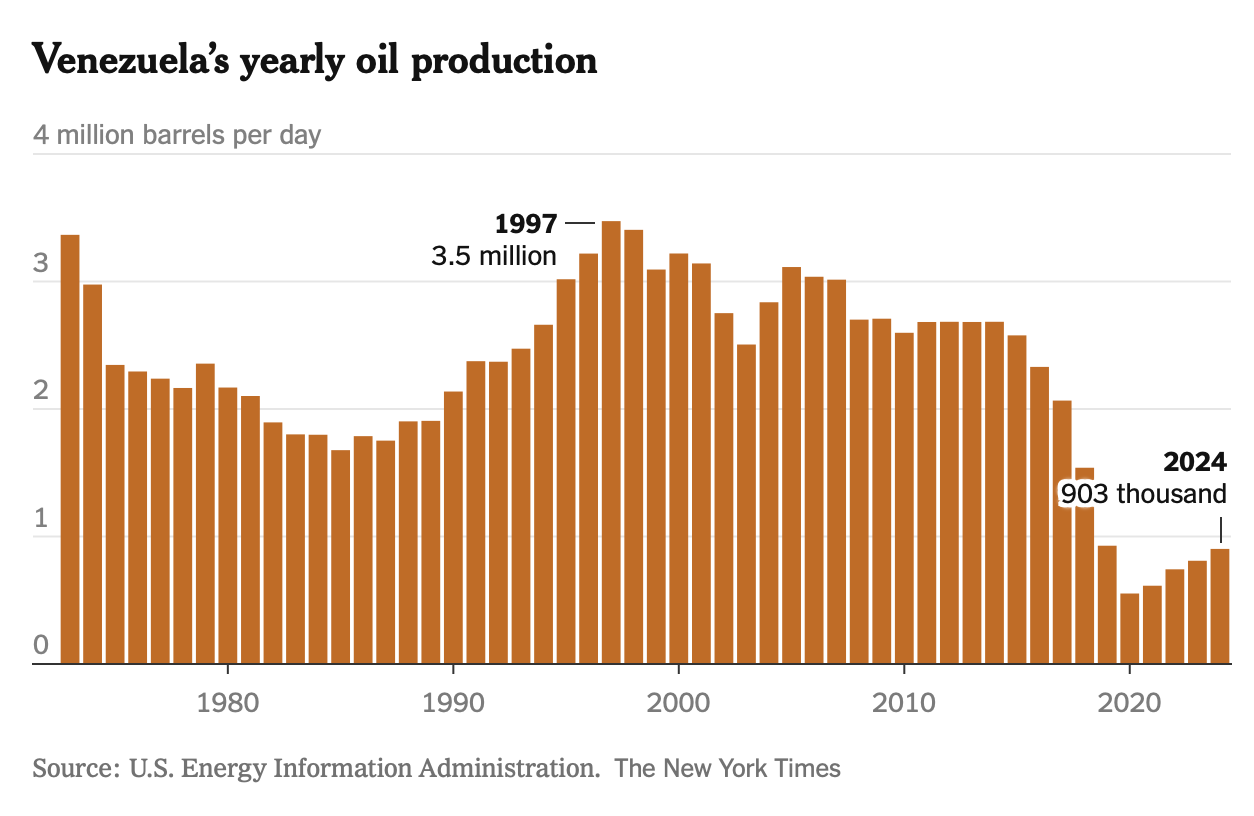

Discussions surrounding Venezuela’s oil fields highlight the need for extensive investments before tangible returns materialize. The situation mirrors the precedent set by Iraq, where real benefits took years to emerge despite military occupation and expectations surrounding oil.

Admittedly, the ongoing embargo is increasing pressure on the Venezuelan government.

Venezuela’s state-owned oil company PDVSA is decreasing crude production due to inadequate storage capacity from an ongoing U.S. embargo that has curtailed exports, exerting increasing pressure on the interim government. https://t.co/eAelegFxHM pic.twitter.com/sIs9UqaQei

— Reuters Business (@ReutersBiz) January 5, 2026

This raises the question: Why not adhere to Plan A? Could this represent yet another expression of Trump’s desire to dominate global narratives? Is it a diversion from mounting pressure concerning the Epstein files or the likelihood of a Russian military victory in Ukraine? In my opinion, the apparent initial success of the “Raid not invade” strategy in Caracas may encourage further escalations.

The mainstream media has understandably expressed skepticism over Trump’s lofty claims regarding oil exploitation. While it’s true that the U.S. has a strong motivation—our refineries predominantly process heavier grades of oil—many are wary of the costs involved. Notably, post-sanction efforts have led the Biden administration to consider Venezuela as a crucial alternative source for crude.

Nevertheless, the challenges surrounding Venezuelan heavy crude remain considerable. The current low oil price environment, fueled by sluggish global growth, complicates matters further. Corporate concerns regarding safety and the risk of expropriation persist. Observers should remain cautious about any optimism stemming from recent meetings with oil executives, as previous narratives of “reconstruction” have shown that enthusiasm may lead to disillusionment.

An article from OilPrice released in late 2025 discussed the logistical difficulties associated with U.S. interests in Venezuela’s oil:

This analysis outlines why Venezuela’s oil is not strategically valuable to the U.S. Significant investments are required to restore infrastructure, and Trump’s justification shifted from narco-terrorism to seizing oil resources. This mirrors the pretexts following the discrediting of “weapons of mass destruction” in the Iraq invasion.

Historically, Iraq had expansive oil reserves, yet actual investment lagged behind expectations despite the war’s initial motivations.

From OilPrice’s insights:

- Despite claims from Venezuelan and Colombian officials, the substantial increase in U.S. domestic oil production reduces the urgency for Washington to seize Venezuelan oil fields.

- The U.S. Gulf Coast refining sector has largely moved away from Venezuelan heavy crude due to facility closures and a pivot towards other suppliers.

- Revamping Venezuela’s deteriorating oil infrastructure to restore meaningful export levels will require considerable time and investments, making military intervention economically unfeasible for the U.S.

The findings reported by the Wall Street Journal align with these observations:

The Trump administration’s initiative to unseat Nicolás Maduro opens potential opportunities for U.S. oil companies, according to Trump’s remarks during a Mar-a-Lago press conference.

However, attracting foreign investment will present significant challenges. Chevron remains the only major U.S. firm active there, and other companies will hesitate, considering the instability and fragmentation of the industry.

The overarching issue is the lack of demand for increased oil production globally, complicating Trump’s ambitions.

For these objectives to materialize, subjugation or cooperation from Venezuela needs to be established—both of which remain uncertain. Chevron’s focus on employee safety indicates rising concerns, and there’s ongoing skepticism about the accuracy of Venezuela’s purported oil reserves, which are claimed to be among the largest globally.

As per the Journal’s findings:

Although the U.S. shale boom has generated exceptional oil production levels, U.S. frackers don’t deliver the types of crude that are comparable to that produced in Venezuela. The government claims its reserves exceed 300 billion barrels, potentially positioning Venezuela’s resources as the largest in the world.

However, major firms interested in re-entering Venezuela will need to approach the situation judiciously, as the country has a history of nationalizing foreign assets.

Addressing the enormous undertaking of reinvigorating Venezuela’s energy sector involves developing comprehensive economic stability plans and facilitating foreign investment amidst a backdrop of authoritarian rule.

Amid all these factors, there remains a crucial note of caution surrounding the likelihood of Trump’s plan coming to fruition. This endeavor risks inflating expectations without delivering tangible results.