Welcome to my first article of 2026! As I embark on another year with Kitco, it’s a perfect opportunity to reflect on my journey that started in 2007 during my time at Lind-Waldock. I am incredibly thankful to both the readers and the Kitco team for your ongoing support and positive feedback over the years. Collaborating with many of you in the futures and commodities space has been a rewarding experience. It brings me joy to see that some of the concepts shared in my articles have inspired you to open trading accounts with Blue Line Futures, where you have successfully engaged in your trading endeavors, particularly in precious metals and additional commodities. Your support means the world to me!

As we enter the first quarter of 2026, we anticipate further appreciation in precious metals prices, coupled with heightened volatility. This increased volatility often leads to more ‘noise’ surrounding these assets. You are familiar with the fundamentals of asset classes like copper, gold, and silver; now, it’s vital to sift through the noise and focus on the signals. This is where technical analysis becomes invaluable.

To assist you in crafting a trading strategy, I revisited 25 years of my trading methodologies and developed a free resource: the “5-Step Technical Analysis Guide.” This guide lays out the essential technical steps needed to formulate a concrete plan for market entry and exit. You can request your copy here: 5-Step Technical Analysis Guide

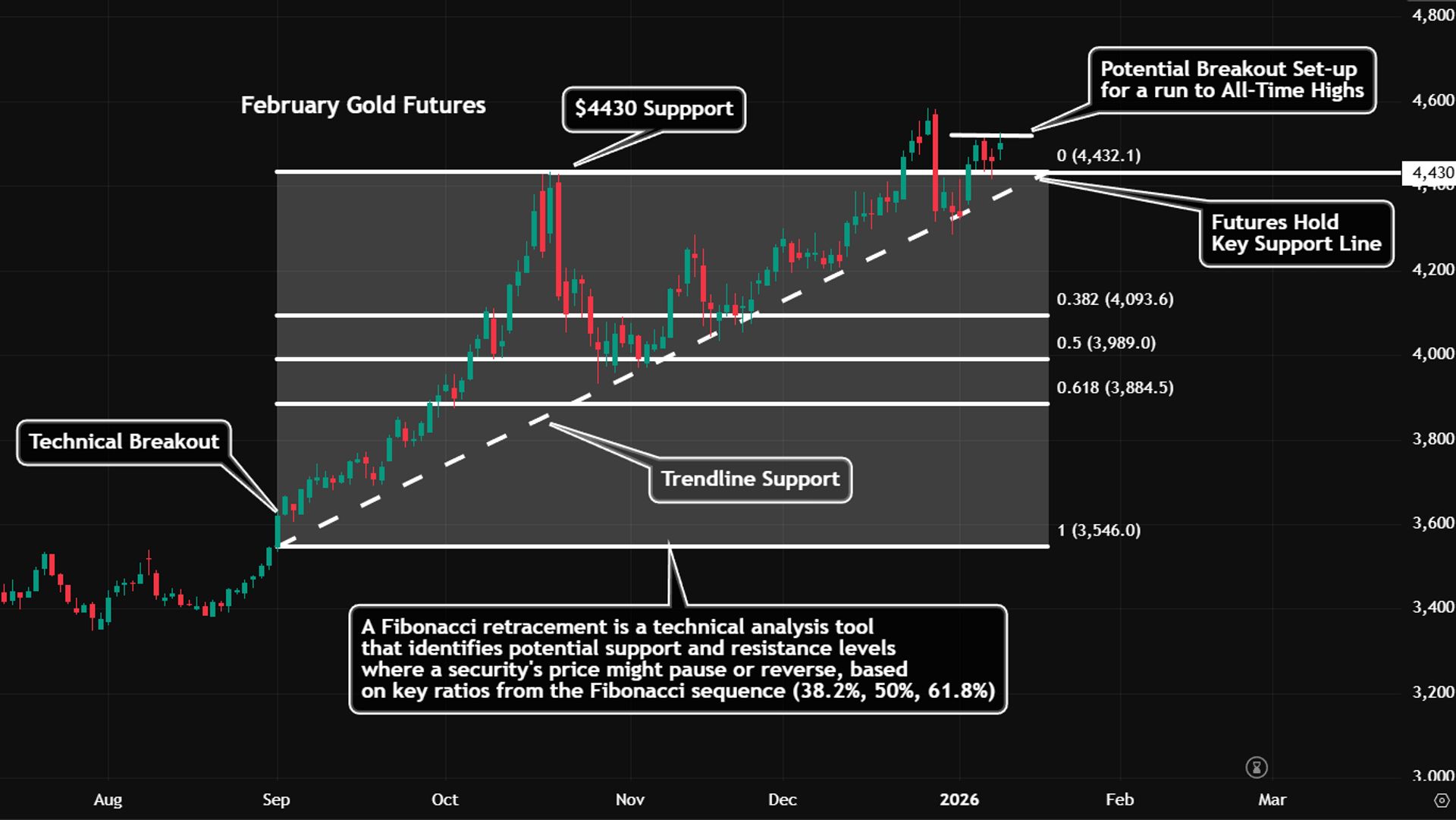

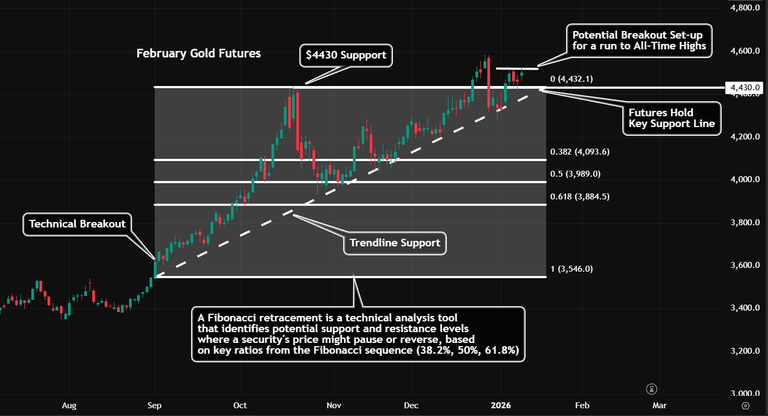

Daily Gold Chart

The recent uptick in futures began in late August 2025, attributed to factors such as concerns regarding U.S. tariffs, a weakening dollar, expectations of looser monetary policies, and purchases by central banks. An examination of the chart shows a technical breakout in early September when futures surged to $4,300 per ounce before retreating to the 50% Fibonacci retracement level. At this point, trendline support began to form, leading to another rally toward new all-time highs. Currently, futures are consolidating between $4,430 and $4,530. A potential breakout above $4,550 could set the stage for a climb to $5,000.

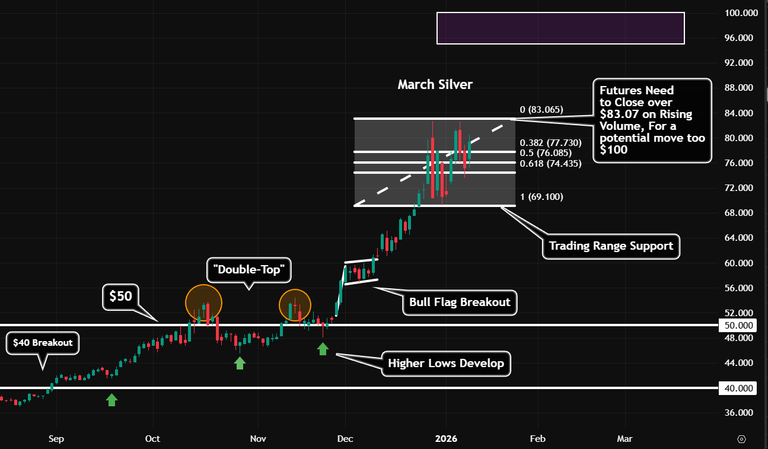

Daily Silver Chart

Like gold, silver also saw a significant rise in 2025, following many of the same fundamental technical principles. After breaking through key resistance levels of $40 and $50 an ounce, futures achieved a double top before establishing a bull flag. This bull flag was eventually broken, propelling the rally until prices peaked at $82.67. Presently, a well-defined trading range has been established between $69.10 and $83.07. We believe that a breakout above this range could lead to prices approaching $100 an ounce.

Understanding technical analysis and chart patterns can ease your trading decisions. While there are multiple interpretations of these patterns, technical analysis is both an art and a science. The key is to identify these patterns and implement a trading strategy based on your predictions for future price movements. Whether you’re a trader or a long-term investor in precious metals, it’s essential to familiarize yourself with basic chart patterns and develop a robust plan that can provide you with an advantage. By integrating various technical analysis chart patterns across different timeframes, you can effectively harness the potential of the futures and commodities markets. Staying ahead in the Silver market has never been simpler. Get the Blue Line Futures Precious Metals Chart Pack today by registering here: Get Precious Metals Chart Pack

Disclaimer: The views expressed in this article belong to the author and may not represent those of Kitco Metals Inc. While every effort has been made to ensure the accuracy of the information provided, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is intended solely for informational purposes and does not constitute a solicitation to engage in commodities, securities, or other financial instruments. Kitco Metals Inc. and the author of this article disclaim any responsibility for losses and/or damages resulting from the use of this publication.